Back in mid-August, I wrote about Fitbit Inc (NYSE:FIT), warning that there could be more problems — and soon. My big concern was that the holiday season would be tough because of a lack of interesting products.

And yes, this did play out, as seen last week when FIT stock plunged 30% on the news of its earnings report.

No doubt, when it comes to the tech hardware market, things can get extremely brutal. Just look at other victims like GoPro Inc (NASDAQ:GPRO) and BlackBerry Ltd (NASDAQ:BBRY). Consumer tastes can be fickle and there is the persistent issue of costly inventory.

Despite all this, might there still be an opportunity with Fitbit stock? After all, the valuation is certainly much more attractive and the company still has a strong market position and brand, right?

Well, all this is true. Yet, investors should still be cautious on FIT stock. So here’s a look at three reasons:

Problem #1 for FIT Stock: The Competition

Competition is not necessarily bad so much as it is a spur for innovation. What’s more, competition is always a sign that there is a market opportunity.

But sometimes things can get too intense, especially when the rivals have enormous resources. Unfortunately, this appears to be the case with FIT stock. Just some of the rivals include biggies like Microsoft Corporation (NASDAQ:MSFT), Samsung Electronics (OTCMKTS:SSNLF), Apple Inc. (NASDAQ:AAPL), Garmin Ltd.

(NASDAQ:GRMN) and Under Armour Inc (NYSE:UA). These operators not only have tremendous financial resources, but can leverage their strong brands and massive customer bases.

Although, AAPL may be the biggest concern. Note this from the latest 10-Q for FIT:

“Apple sells the Apple Watch, which is a smartwatch with broad-based functionalities, including some health and fitness tracking capabilities, and Apple has sold a significant volume of its smartwatches since introduction. Moreover, smartwatches with health and fitness functionalities may displace the market for traditional connected health and fitness devices.”

Problem #2 for FIT Stock: Innovation and Pricing

Fitbit invests aggressively in R&D, with the expenditures at nearly 15% of overall revenues. But translating this into products that get the attention of consumers is still dicey.

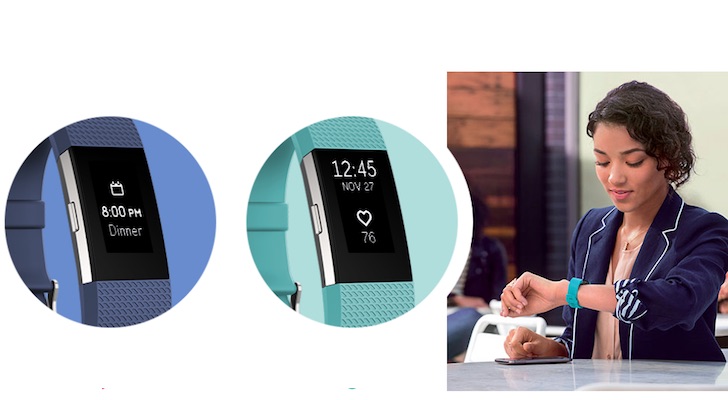

The latest quarter is certainly a reminder of this. Despite launching new fitness trackers — Fitbit’s Charge 2 and Flex 2– that have generally brought in strong revenues, this was not enough to keep up the growth ramp. Consider that the guidance for the holidays calls for revenues to inch up only 2% to 5% (on a year-over-year basis), or between $725 million and $750 million. The Street consensus was for a much more robust $985 million.

But digging deeper into the numbers, the real concern is actually in the Asian market, where sales plunged a staggering 45% in Q3. The fact is that the competitive environment is brutal, as local operators have been able to pump out quality offerings at rock-bottom prices.

Going forward, there is little clarity on the product roadmap for FIT as well. According to a recent report from SunTrust Robinson Humphrey, new models may not hit the markets until “well into 2017.” In other words, there may not be any meaningful catalysts for FIT stock for some time.

Problem #3 for FIT Stock: Not a Must-Have for Consumers

How many would have a tough time living without their smartphone? My hunch is the number is enormous.

But what about a fitness tracker? Well, it would probably be a small fraction. A fitness tracker is essentially a nice-to-have product — but not really a must-have for consumers. If anything, various studies highlight this. For example, in the Lancet Diabetes and Endocrinology, a group was divided among those who received a cash payment for wearing a fitness tracker and those who got zero.

Should it be surprising what the results were? Of course not. The group that did not receive the cash eventually abandoned their devices.

Now this does not mean the opportunity for the overall market is somehow bad. But then again, it seems reasonable that sustainable enthusiasm for using a fitness tracker can be fleeting — and this could certainly limit the potential of the monetization.

Tom Taulli runs the InvestorPlace blog IPO Playbook and also has his own tax preparation firm. Follow him on Twitter at @ttaulli. As of this writing, he did not hold a position in any of the aforementioned securities.