Semiconductor stocks have delivered amazing returns over the past year. The leading semiconductor stocks ETF, iShares S&P NA Tec. Semi. Idx. Fd.(ETF) (NASDAQ:SOXX) is up 50% over the last year. While stocks in general and tech in particular have performed admirably over the past year, semiconductor stocks have eclipsed their returns with ease.

The SOXX ETF comes with the following top-five holdings. Texas Instruments Incorporated (NASDAQ:TXN) is the top holding at 8% of the semiconductor stocks ETF. Broadcom Ltd (NASDAQ:AVGO), Intel Corporation (NASDAQ:INTC) and Nvidia Corporation (NASDAQ:NVDA) are up next.

The ETF weights all three between 70% and 8% of assets. Qualcomm, Inc. (NASDAQ:QCOM) rounds out the top five at 7.2% of the fund.

With the exception of QCOM stock, the whole bunch has traded strongly over the past year. NVDA stock has blown away all competition, rising as much as 400% off its low. Texas Instruments and Broadcom have also soared. Even after the huge runs, however, investors can still find opportunity within semiconductors. But now is the time to be selective.

I don’t have a view on Broadcom; here’s how the other four semiconductor stocks shake out.

Texas Instruments Incorporated (TXN): Great Growth and Income Play

Texas Instruments is the largest holding in the semiconductor space. However, it tends to fly under the radar. Many investors don’t realize just how strong this $80 billion market cap company is.

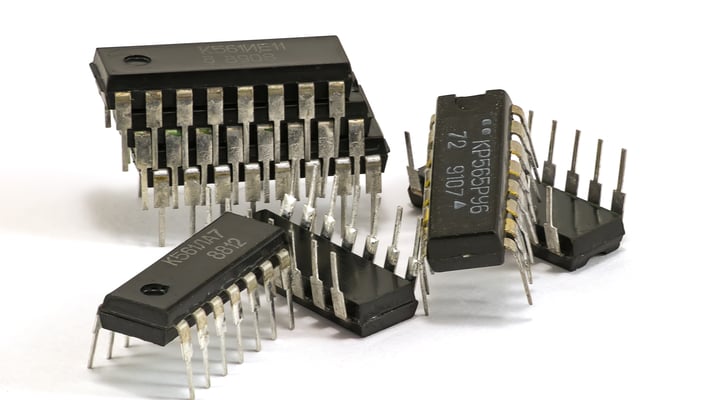

The company’s core strength is in analog semiconductors. These are the chips that decode signals from the real world and convert them into digital signals. Think applications for light, heat, and pressure sensing. Over the years, TXN has built a huge business on these chips; it has a massive R&D edge in its niche, and offers thousands of specialized SKUs.

However, Texas Instruments hasn’t competed much in the big semiconductor categories such as iPhone suppliers, PC chips, graphic cards and other high-end stuff. Thus investors tend to miss out on the TXN stock story.

Nowadays, the big driver for Texas Instruments stock will be auto. A self-driving car needs all sorts of input from the real world to function. TXN leads the way in powering that sort of technology. Everyone loves NVDA stock for autos, but consider Texas Instruments stock as a much cheaper alternative.

TXN trades at just 23x earnings and offers a 2.5% dividend yield. The company has grown earnings at a 16% annualized rate and the dividend at 23% per year over the past five years. For that level of growth and a call option on self-driving cars, 23x earnings is a more than reasonable price making it arguably the most attractive of the semiconductor stocks.

Qualcomm, Inc. (QCOM): Take Advantage of Lawsuit Worries

Qualcomm has been the one stinker out of the semiconductor space over the past year. QCOM stock has dropped from its 52-week high at $71 to just $53 today. The company has hit some real concerns, particularly related to patent protection lawsuits.

However, the market is probably too concerned about short-term issues. I respect the lawsuit risk. I understand why authors are concerned about further liability going forward. But the recent issue with BlackBerry Ltd (NASDAQ:BBRY) is a limited matter that shouldn’t have broader ramifications. And focusing on lawsuits misses the big picture.

Qualcomm’s transformational merger bid for NXP Semiconductors NV (NASDAQ:NXPI) is coming closer to fruition. The deal just picked up U.S. approval earlier this month. The general sentiment is that QCOM got a great deal. That perception continues to grow as Intel paid a far higher price for a much more shaky asset in the form of Mobileye NV (NYSE:MBLY).

QCOM stock is just 6% off its 52-week low. It trades at a 17x price-to-earnings ratio, and offers a 4.3% dividend yield. That’s all cheap, and likely to re-rate significantly higher once the NXP deal closes.

Intel Corporation (INTC): Great Core Business, But Not Much Growth

After topping $100 per share during the dot-com bubble, Intel shares lost most of their value. INTC stock recently hit 15-year highs, however, as investors have finally started to respect the company’s prodigious cash flow generation.

At a 3% dividend, one which is frequently increased, and a 17x P/E, INTC stock is fine for a blue-chip holding.

However, the company faces a lingering issue. It relies on the core PC business to generate much of its earnings. PC appears to have stabilized, but it’s never going to much of a growth business again. Intel can keep milking the PC chip cash cow, it doesn’t have much viable competition there. However, it isn’t clear what exactly Intel can do to deliver much upside going forward.

The company recently announced a big deal for Mobileye. Respected short sellers, including Citron Research, had long suggested that Mobileye’s business was more style than substance.

While much of Mobileye’s proprietary technology is hard to value today, it’s fair to say that the deal has plenty of skeptics. Ultimately, INTC stock should perform alright as long as it keeps returning large amounts of its cash flow to shareholders. The lack of a clear growth driver and the risk of more questionable M&A have Intel at just a hold for now though.

Nvidia Corproation (NVDA): Overhyped and Poised to Drop

Nvidia has a great growth story. No one is arguing that. However, the valuation at today’s price assumes torrential growth going forward.

At 40x earnings, you would need all sorts of things to go right for NVDA stock to justify a higher price. After a stock moves from 20 to 100, absolutely everything has to be hitting on all cylinders to support more upside.

Instead, cracks are forming in Nvidia’s story. The stock has gotten hit with two rounds of negative analyst commentary in April. Earlier this month, Pac Crest downgraded the stock, triggering at 7% decline in shares. Their analyst suggested that graphic cards aren’t growing at all and that the PC business has also hit a slow patch. BMO piled onto this sentiment more recently, reiterating an $85 price target. Their analyst said the slowdown in graphic cards is much worse than the market thinks.

NVDA stock also faces an increasingly perilous stock chart technically. If the support level around $90 to $95 per share doesn’t hold, the stock could easily slide to the $70s before finding more interested buyers. Nvidia should put up scorching revenue growth in coming quarters, but it’s all priced into the stock and then some.

You’ll likely be able to get this stock much cheaper at a later point in 2017. At today’s price, it’s the worst of the semiconductor stocks, and you should probably steer clear.

At the time of this writing, Ian Bezek held TXN, QCOM, and INTC stock. You can reach him on Twitter at @irbezek.