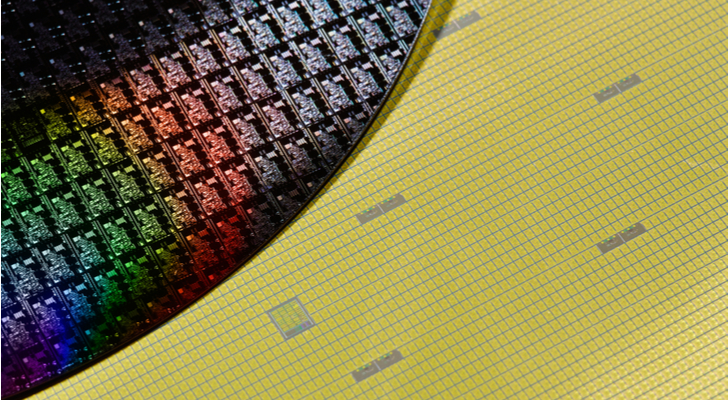

The semiconductor industry is as hot as it’s ever been. Companies like Micron Technology, Inc. (NASDAQ:MU), Nvidia Corporation (NASDAQ:NVDA) and AMD are shooting stars and some setting new all time highs. The PHLX Semiconductor (NASDAQ:SOX) index is near an all-time high it just set back in March.

We now live in a world that is more dependent on technology than ever. And this is not slowing down. The rate of adoption of technology into our everyday lives is accelerating at an exponential rate. So suppliers to the industry are likely to prosper for years to come.

Lam Research Corporation (NASDAQ:LRCX) is one of those suppliers and a successful one at that. Its management is proven over the years and dips in the stock are usually opportunities for long-term investors.

This morning LRCX is falling 6% without a major catalyst for it that I can see. We may find out after the fact the cause of the dip but for now I will trade it based on what I know about its fundamentals and technicals.

Fundamentally, LRCX stock only sells at a 12 price-to-earnings ratio. This is cheap and relative and absolute terms. Yes, it could get cheaper but if that happens then it would be an even better point of entry. This is important to the trade set up today.

I use options so I can build myself some room for error just in case the selling persists a bit longer. The macroeconomic conditions are good. But the stock market is near or at all-time highs so caution is a good idea at this point. This is especially true because we have several looming issues like Global tariffs Wars and your political unrest.

Click to Enlarge Technically, Lam Research stock has traded in a wide range this year. After this morning’s dip, the stock would be flat for 2018. But for the past 12 months it’s up 20% and in line with the equity markets.

The $10 wide area around $170 per share has been pivotal for the last 12 months. Those tend to be support on the way down. Neither bulls nor bears are ever willing to give up easily without a fight thereby creating congestion.

LRCX stock has its fans in the media and on Main Street so I expect bulls to put up a good fight. I will sell downside risk into what others fear to create income out of thin air.

LRCX Stock Trade Idea

The Trade: Sell the LRCX Oct $145 naked put and collect $2.75 to open. Here I have a 85% theoretical chance that I would retain maximum gains. But if price falls below my strike then I accrue losses below $142.25.

Selling naked puts is daunting. Those who want to mitigate that risk can sell spreads instead.

The Alternate Trade: Sell the LRCX Oct $150/$145 bull put spread where I have the same odds of winning. Then the spread would yield 12% on risk.

Click here for more my market thesis and get an ongoing free copy of my weekly newsletters.

Nicolas Chahine is the managing director of SellSpreads.com. As of this writing, he did not hold a position in any of the aforementioned securities. You can follow him as @racernic on twitter and stocktwits.