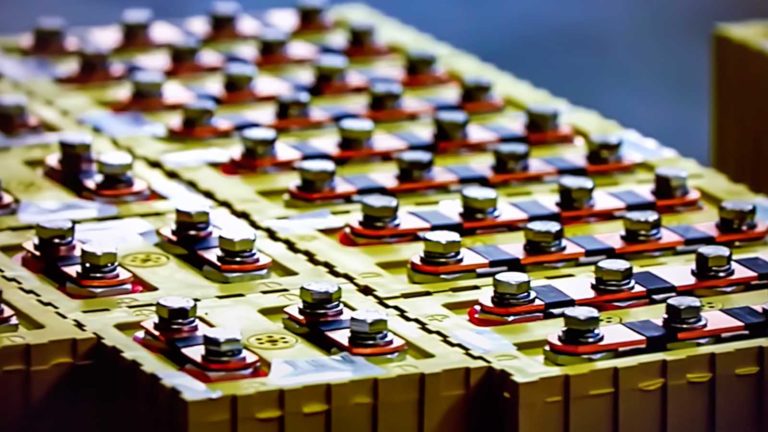

The lithium-ion battery is a technological breakthrough that can change every aspect of our lives. No surprises that lithium stocks are doing exceptionally well.

The explosive demand for electric vehicles has led to lithium becoming one of the most highly sought-after commodities. The concept is so highly valued that it helped its creators earn the Nobel Prize in chemistry.

The Royal Swedish Academy of Sciences, the presenters of the Nobel, said, “Lithium-ion batteries have revolutionized our lives since they first entered the market in 1991. They have laid the foundation of a wireless, fossil-fuel-free society and are of the greatest benefit to humankind.”

Such high praise is warranted especially considering the technology’s impact on EVs. Quantum glass batteries are a type of solid-state battery using a glass electrolyte and lithium or sodium metal electrodes. They represent the “holy grail” for the EV sector. It aims to solve the two most pressing issues preventing EVs from wider adoption, limited battery life, and slow charging times.

Investing in lithium stocks becomes an effective way to play this red-hot trend. The following list contains five companies that are pioneering the space:

- Albemarle (NYSE:ALB)

- Piedmont Lithium Limited (NASDAQ:PLL)

- Energizer Holdings (NYSE:ENR)

- Lithium Americas (NYSE:LAC)

- Livent (NYSE:LTHM)

Lithium Stocks to Buy: Albemarle (ALB)

Albemarle is a North Carolina-based company that conducts its business under three segments: lithium, bromine specialties and catalysts arms.

Shares of the world’s leading lithium producer have outperformed the S&P 500 by 111% in the past year. And the momentum will not stop considering the company’s positive operating performance.

In the last four quarters, the company beat Wall Street analysts’ consensus earnings estimates every time, per CNBC data. It serves several end markets, everything from petroleum refining and energy storage, food safety and custom chemistry services.

The only issue I have with ALB stock is valuation. Considering its pole position in the sector and its operating performance, shares are trading at a premium at the moment, 43.4x forward price-earnings. Even though the stock has shed 15% of its value in the last three months, I would wait for it to drop a bit more before buying in.

Piedmont Lithium (PLL)

Many investors were not familiar with Piedmont Lithium before last year. However, in October 2020, it inked an agreement to supply 33% of its planned annual spodumene production of 160,000 metric tons from its North Carolina mines to Tesla (NASDAQ:TSLA).

Understandably, anything related to Tesla is hot at the moment. After the announcement, the stock shot up to its 52-week high of $88.97 per share.

Apart from the Tesla deal, Piedmont Lithium has also signed a deal with Sayona Mining (OTCMKTS:DMNXF) to expand its productive capacity and outreach.

Before these two agreements, the stock usually traded between $7 and $8. In the fourth quarter, the company took advantage of the situation and issued 2.3 million American Depositary Shares (ADS), each of which represented 100 PLL shares, at $25.

PLL is targeting an annual output of 22,700 tons of battery-quality lithium hydroxide. If it manages to attain this target by the end of 2022, then stockholders will be willing to stomach the dilution. As it stands at the moment, the stock is a bit expensive.

PLL has corrected since its all-time high, but it needs to shed more value before becoming an attractive proposition.

Energizer Holdings (ENR)

Energizer Holdings is one of the most recognizable battery brands globally that use lithium in its products. The company operates in North America, Europe, Asia Pacific, Latin America, Middle East and Africa, with the bulk of revenue from the U.S.

Products are sold under the Energizer and Eveready brands. For several years, the company has been an excellent performer.

In its latest quarter, Energizer Holdings reported EPS of $1.17 compared to 85 cents in the prior-year quarter and beat analyst expectations by 31.5%. Revenues of the fiscal first-quarter reported net sales of $848.6 million, up 15.2%.

Last year, the company’s reported revenue increased by around 10%, or $250 million to almost $2.75 billion, excellent considering the novel coronavirus pandemic. You can add a dividend yield of 2.4%, and you have all the makings of one of the best lithium stocks.

Lithium Stocks to Buy: Lithium Americas (LAC)

A running theme for this article on lithium stocks is potential. And if potential is any reason to map the stock, then Lithium Americas should be at the top of the list.

As the electrification of transportation increases, it has a lot to gain from its Thacker Pass project in Nevada. According to the company, production is slated to begin on the project in the latter half of 2022. It has one other project in Argentina, with production expected to start on this one in mid-2022.

Earlier this year, the company issued stock that grossed proceeds of $400 million. That gives it a lot of cash to finance further growth. Stockholders never appreciate dilution. However, since it’s still early days for the company, investors can let it go for the time being.

TipRanks tracks five analysts offering 12-month price targets for Lithium Americas. The average price target is $23.10, representing a 65% increase from its current price.

Livent (LTHM)

Livent started trading in October 2018 after spinning off from agricultural sciences group FMC (NYSE:FMC). The company has manufacturing sites in the U.S., U.K., India, China, and Argentina, giving it a lot of geographical diversification.

Even though the financials of the Philadelphia-based company are lukewarm, its supply partnership with Tesla keeps investors interested.

During its third-quarter earnings call, CFO Gilberto Antoniazzi said, “We continue to discuss the framework for a long-term supply partnership with Tesla beyond 2021 and view this as an important step in helping to bridge the gap as we strengthened our long-standing relationship.”

The company has also inked a $335 million agreement with BMW (OTCPK:BMWYY) to source lithium for its battery-cell production.

Despite all this, shares are down 25% in the last three months. It’s mainly due to lackluster fourth-quarter earnings. But for me, the price correction gives further incentive to load up on this one, making it one of the more attractive lithium stocks out there.

On the date of publication, Faizan Farooque did not have (either directly or indirectly) any positions in the securities mentioned in this article.

Faizan Farooque is a contributing author for InvestorPlace.com and numerous other financial sites. Faizan has several years of experience analyzing the stock market and was a former data journalist at S&P Global Market Intelligence.