Chinese EV stocks are on the rise this morning. Nio (NYSE:NIO), Xpeng (NYSE:XPEV) and Li Auto (NASDAQ:LI) all rose in pre-market trading as they reported their electric car deliveries for July.

XPeng, built by entrepreneur He Xiaopeng and backed by Alibaba (NASDAQ:BABA), had the best month, delivering 11,524 vehicles. Li delivered 10,422 and Nio 10,052.

While the numbers were all up from a year ago, they were notably down from June.

Still, XPEV stock was up 2.54%, LI and Nio up almost 3%, in pre-market trading. While there remains the threat of de-listing for all Chinese stocks, including Alibaba, investors seem willing to take the risk with electric cars.

New European Exports

Nio began building a European presence last year through Norway, where about one-third of all new cars are now electric. It is expanding into four more markets this year, including Germany, and hopes to be in 25 countries by 2025. It calls its stores “Nio Houses” where drivers can swap out batteries in under an hour.

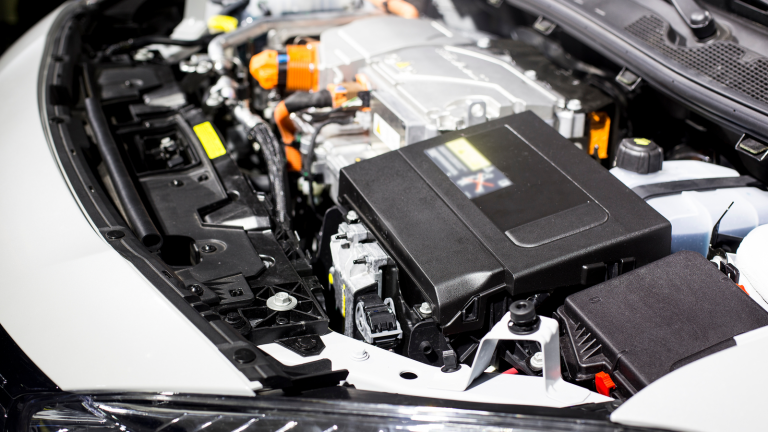

Xpeng has begun taking European orders for its P5 family sedan in Scandinavia. Li has yet to announce any export plans. While Xpeng and Nio make full-on electrics, called BEVs, Li’s focus is on plug-in hybrids (PHEV), which can be recharged but also include gasoline engines.

Where’s the Growth?

All three companies are small players in their home market of China.

While Tesla

(NASDAQ:TSLA) sells well in China, the biggest market is dominated by BYD (OTCMKTS:BYDDY), in which Berkshire Hathaway (NYSE:BRK-A, NYSE:BRK-B) still has a significant stake, Tesla, and SAIC Motors, which only trades in Shanghai but in which General Motors (NYSE:GM) has a stake. The three together hold about 45% of the Chinese market for plug-in cars.

The top-selling car is a SAIC model, the Wuling Hongguang Mini EV. It has a top speed of 62 mph and goes just 75 miles on a charge, but also costs a little over $4,000. The company is building a plant in Indonesia and will focus exports on Southeast Asia.

In comparison, Nio, Xpeng and Li’s cars are considered luxury vehicles, like Teslas. The Nio ES8 costs the equivalent of $65,000 in Norway.

What’s Next for Chinese EV Stocks

All the Chinese sedan makers compete directly with Tesla, in both home and export markets.

None are yet scaled to beat it. But they could be competitive with GM and Ford Motor (NYSE:F) as they ramp up electric car production.

On the date of publication, Dana Blankenhorn had long positions in BABA. The opinions expressed in this article are those of the writer, subject to the InvestorPlace.com Publishing Guidelines.