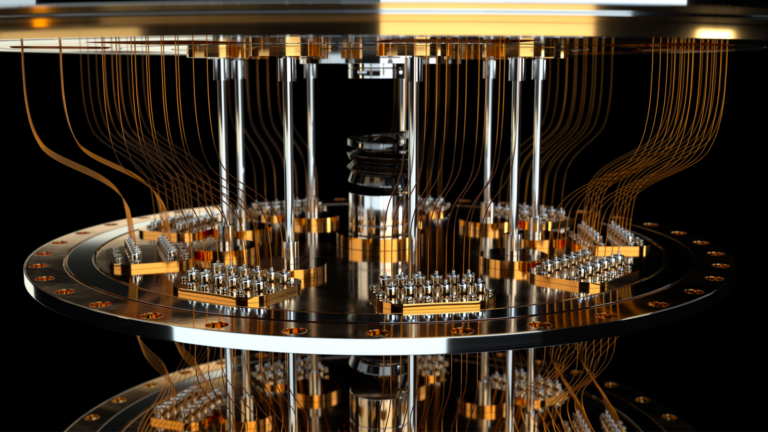

The quantum computing industry is experiencing significant growth, with advancements in both hardware and software making it a key consideration for organizations looking to invest in cutting-edge technology. To this end, we look at some of the top quantum computing stocks to buy as businesses utilize this next-gen technology across various industries.

Major tech players are increasingly interested in making significant investments in quantum computing to align with the rapid pace of technological advancements amid customers’ current demands, which are seeking innovative computational solutions.

Drawing on data from the quantum market and insights from industry thought leaders gathered in the fourth quarter of 2023, the recent ‘State of Quantum 2024’ report noted the transition from theoretical exploration to practical application, highlighted by the emergence of full-stack quantum computer deliveries in national labs and quantum centers.

In 2022, venture investments in quantum technology soared to over $2 billion amid strong investor confidence in this burgeoning field. However, by 2023, these investments saw a sharp 50% drop, sparking debates about a potential “quantum winter.”

Industry experts argue the decline reflects broader venture capital trends and not a loss of faith in the quantum sector’s prospects. Government funding has increasingly filled the gap private investors left, mitigating concerns over the investment slowdown.

The bottom line is the quantum industry is still advancing, albeit at a moderate pace. This emphasizes the need for realistic expectations and a sustained commitment to research and development. Despite the recent dip in investment, the sector’s insiders remain cautiously optimistic about its future. This suggests the industry is far from stagnating.

Let’s take a closer look at leading quantum computing stocks to buy.

Intel (INTC)

Intel (NASDAQ:INTC), the semiconductor giant, is actively pursuing a turnaround strategy to regain its leadership in the technology industry. The plan involves a significant restructuring of its operations, investment in advanced chip manufacturing technologies and a renewed focus on innovation.

Among other things, Intel is pushing hard to develop its quantum computing products. The chipmaker introduced Tunnel Falls, a quantum computing chip leveraging the company’s cutting-edge manufacturing techniques.

The company has collaborated with various government and academic research entities to facilitate the testing of Tunnel Falls. According to Intel, the new chip has a 95% yield rate across the wafer and voltage uniformity.

Quantum computing isn’t the core focus of Intel’s strategy to reclaim its semiconductor industry leadership. However, the initiative represents a potential growth area. Success in quantum computing research could position Intel as a key player in this innovative technology domain in the future. This could make Intel one of the top quantum computing stocks to buy.

Alphabet (GOOGL, GOOG)

Similarly to Intel, Alphabet (NASDAQ:GOOGL, NASDAQ:GOOG) is making significant strides in quantum computing through its subsidiary, Quantum AI. Focusing on developing quantum processors and algorithms, Google’s parent company aims to harness quantum technology for breakthroughs in computing power.

Alphabet recently exceeded Q4 earnings expectations with a net income of $20.69 billion and a 13% revenue increase to $86.3 billion. Its advertising revenue of $65.52 billion slightly missed analyst projections.

While fighting Microsoft (NASDAQ:MSFT) on the AI front, Google has also ventured into the quantum computing realm with its proprietary quantum computing chips, Sycamore. In a strategic move, Google spun off its quantum computing software division into a standalone startup, SandboxAQ, in March 2022.

Its dominant position in search drives Google’s foray into quantum computing. It aims to develop more efficient, faster and intelligent solutions. The company plays a crucial role in managing vast volumes of digital information. It can gain immensely by enabling various organizations to harness the transformative power of quantum computing and AI.

FormFactor (FORM)

FormFactor (NASDAQ:FORM), a leading provider in the semiconductor industry, specializes in the design, development and manufacture of advanced wafer probe cards. These probe cards are essential for the electrical testing of semiconductor wafers before cutting them into individual chips.

FormFactor is strategically positioned within the quantum computing ecosystem through its semiconductor test and measurement solutions expertise. The company provides advanced systems essential for developing and testing quantum computing chips. These systems are designed to operate at extremely low temperatures, a fundamental requirement for quantum computing experiments where qubits must be maintained in a coherent state.

Its flagship products include precision engineering solutions like the Advanced Matrix series for high-density applications and the TouchMatrix series for touchscreen panels. FormFactor’s products enable semiconductor manufacturers to perform reliable and accurate testing at various stages of the production process. This ensures the functionality and quality of the final semiconductor products.

Last month, FormFactor reported a modest top-line year-over-year increase of 1.3%, reaching $168.2 million. Looking ahead, expectations for the first quarter are aligned with the recent quarterly performance, with projected revenue of around $165 million.

On the date of publication, Shane Neagle did not hold (either directly or indirectly) any positions in the securities mentioned in this article. The opinions expressed in this article are those of the writer, subject to the InvestorPlace.com Publishing Guidelines.