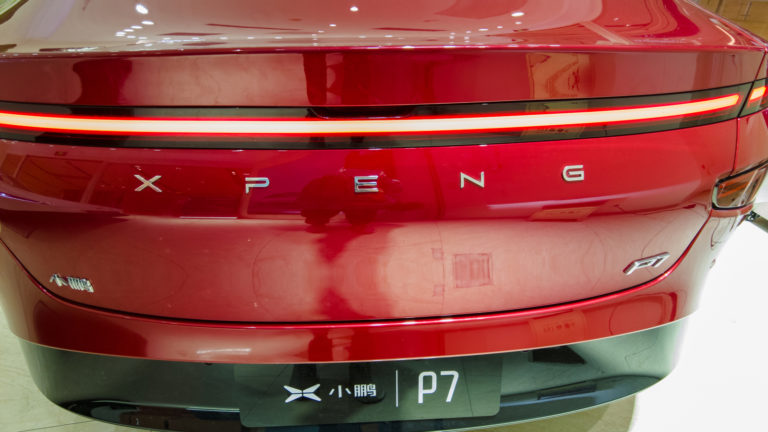

It’s been a tough environment for electric-vehicle manufacturers, with global sales slowing despite some bullish developments in specific regions. Such a framework puts China’s EV maker XPeng (NYSE:XPEV) in the hot seat. Although the company builds high-performing and aesthetically pleasing vehicles, the competition is fierce. However, if it manages to survive the onslaught, XPEV stock could be an attractive (albeit speculative) opportunity.

According to a CNN report, China’s automotive insiders describe the marketplace as a “life and death race.” With so many brands competing for limited consumer funds, several smaller to medium-sized enterprises may be forced to shut their doors permanently.

At the same time, surviving this war of attrition could yield robust gains. Per CNN, later this year, “the market share of electric cars could reach up to 45% in China, underpinned by competition among manufacturers, falling battery and car prices and ongoing policy support.”

Making the case for XPEV stock, the underlying company posted strong results for its first-quarter earnings report. Ahead of the disclosure, analysts anticipated XPeng to post a loss of 34 cents on sales of $863.52 million. Instead, it posted a loss of 20 cents on revenue of $910.95 million.

XPeng Could Potentially Grow Into its Multiple

Despite the strong print, not everything about XPEV stock is wonderful. In particular, many investors are worried about its valuation. Right now, shares trade at 1.58x trailing-year revenue. That’s noticeably above the sector median value of 0.83x.

While that’s a challenge, it should be noted that analysts anticipate huge growth in fiscal 2024. On average, they estimate that sales could hit $6.33 billion, which would imply a year-over-year growth rate of 47%. Moreover, the blue-sky target calls for $7.78 billion, up 80.5% from the prior year’s tally of $4.31 billion.

Get this – even the least-optimistic forecast of $5.03 billion still implies 16.7% growth.

Assuming that the projections hold up, XPEV stock needs to be considered in a broader context. Let’s say that the shares outstanding count of 943.38 million remains the same. If so, XPEV is trading at 1.22x projected consensus 2024 revenue. At the high end, shares would carry a sales multiple of 0.99x.

That still doesn’t make XPEV stock undervalued. However, throughout fiscal 2023, the security ran an average sales multiple of 3.93x. Therefore, trading at 1.22x forward sales, XPeng can potentially grow into its valuation.

Trade of the Day: Buy XPEV Stock

Assuming that you believe in analysts’ projections and also in building off the market’s prior support of a much higher sales multiple, XPEV stock could be a deal right now around $8 a pop. From a short-term and long-term perspective, then, it might make sense to simply acquire shares in the open market.

For those who want to amplify the risk-reward profile, the options market presents a possibly viable idea. In particular, I’m looking at the 19 July 2024 $9 call. Last Friday, this option featured a premium of $63 (63 cents multiplied by 100 shares). The bid-ask spread as represented by the midpoint price was also reasonable at 3.13%.

It’s an out the money (OTM) call option so the idea here is to gamble that a mixture of intrinsic and time value will make this trade profitable. If betting purely on intrinsic value, XPEV stock would need to rise above $9.63 per share.

That seems doable – again, if you believe in the analysts’ projections – since the consensus price target calls for $12.50 per share.

On the date of publication, Josh Enomoto did not have (either directly or indirectly) any positions in the securities mentioned in this article. The opinions expressed in this article are those of the writer, subject to the InvestorPlace.com Publishing Guidelines.