Semiconductor stocks are more than halfway home from producing a remarkable comeback. Year-to-date, the popular exchange-traded fund Market Vectors Semiconductor ETF (MUTF:SMH) is up 21%.

This reverses 2015’s disappointing showing, where the SMH ended up flat. The leading companies within the sector made critical adjustments, resulting in broad strength across several semiconductor stocks.

It’s no secret that the personal computer market has absorbed a hammering. That was made all the more clear by the revenue trends of key players like Intel Corporation (NASDAQ:INTC). But the raw numbers behind global PC sales tell the real tale. In 2000, there were nearly 135 million computers sold. Ten years later, that figure jumped to 346 million. Last year, however, total sales fell to 235.5 million, or a 31% loss.

Another change that has been developing for decades is that American semiconductor stocks can no longer depend upon home court advantage. In 1975, PC sales in the U.S. accounted for 80% of all computer purchases. In 2011, only 27% of global PC sales found their way to American homes. That rate rose to 30% last year, but largely because of the dearth in overall demand.

That has placed a lot of pressure on semiconductor stocks. Fortunately, many of them are responding well. Whether it’s shifting to high-growth areas like data centers for cloud computing, or a focus on business-to-business strategies, chipmakers are forging ahead.

Here are three semiconductor stocks that are winning the markets!

Semiconductor Stocks to Buy: Broadcom Ltd (AVGO)

Click to Enlarge

At least one sector isn’t complaining too much about the stronger U.S. dollar. Although mergers and acquisitions have been slowing down across the globe, technology companies remain one of the few exceptions, especially between American and British companies.

That’s a boost for semiconductor stocks like Broadcom Ltd (NASDAQ:AVGO), which can seek out deals that would otherwise have been too pricey. Better yet, the recent Brexit fiasco hasn’t affected M&A enthusiasm for semiconductor stocks.

For AVGO in particular, their continued outperformance in the financials is attracting considerable attention. Since at least 2013, they’ve exceeded all expectations for earnings. That bodes very well for when AVGO releases its third quarter of fiscal year 2016 results in a few weeks.

In addition, AVGO is one of the more broadly diversified names among semiconductor stocks. Their exposure to four primary markets, including wireless communications and enterprise storage, ensures that Broadcom will stay relevant in a volatile industry.

There’s no arguing with the technical results. AVGO stock is up 25% year-to-date after fighting through some early drama. But from mid-February, it has been largely onwards and upwards. AVGO hasn’t dipped below its 200-day moving average since late-February, and has only occasionally crossed underneath its 50-day moving average. Overall, shares look to reassert the sharply rising trend channel that was in place between the second half of 2013 and the summer of 2015.

AVGO has clearly found its mojo, and it will probably reward investors for their patience.

Semiconductor Stocks to Buy: Texas Instruments Incorporated (TXN)

Click to Enlarge

Texas Instruments Incorporated (NASDAQ:TXN) is another name among semiconductor stocks that will be eager to put 2015 behind them. Although TXN’s 8% return last year wasn’t necessarily bad, it was a far cry from its usual outperformance.

Both 2013 and 2014 saw double-digit returns for TXN buyers, and a large group of investors has grown accustomed to the high profitability. After a sharp drop-off in mid-January, things are now looking very favorable for TXN.

That shouldn’t be too surprising, given that TXN has the highest profitability margins among semiconductor stocks. But what makes Texas Instruments even more remarkable is that margins from top to bottom have been consistently increasing over the last few years.

Simply put, the other featured semiconductor stocks cannot make this statement. The focus on the bottom line has also mitigated slow revenue growth. For example, TXN only saw 1% sales growth in its most recent Q2 earnings report. However, net income jumped 12%.

What matters, of course, is what shareholders think. So far, they’ve bought into the TXN resurgence. On a YTD basis, shares are up 27%. Also, TXN flew up following its Q2 report, and momentum is still going strong. Options activity indicates that traders don’t see too much downside risk, and are piling onto bullish strategies.

We’re still a few months out from the end of the year, but so far, it’s looking great for TXN stock.

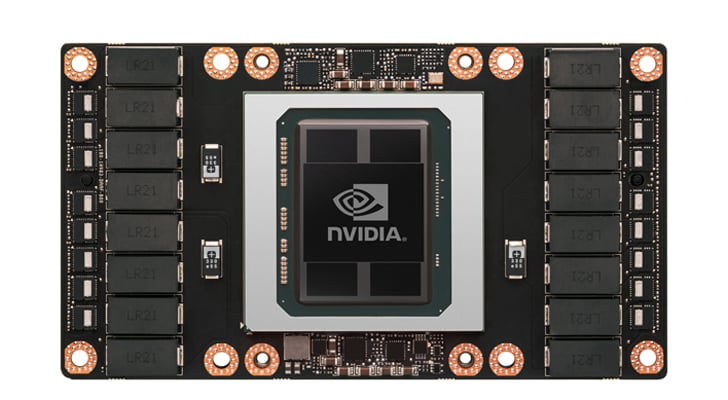

Semiconductor Stocks to Buy: Nvidia Corporation (NVDA)

Click to Enlarge

While the PC market may be on life support, the one sector giving it a ray of hope is gaming. Despite the shift towards smart phones and tablets, these are poor platforms for video games. And that’s music to the ears of Nvidia Corporation (NASDAQ:NVDA).

NVDA is a leading designer of graphics cards for both retail and professional users. The company often butts heads with fierce rival Advanced Micro Devices, Inc. (NASDAQ:AMD). In terms of long-term stability, though, there’s no topping NVDA.

Similar to Texas Instruments, the profit margins for NVDA are ranked among the best of semiconductor stocks. What makes NVDA stand apart is that the company has shown tremendous top-line growth recently. Since Q4 FY2015, quarterly revenue growth year-over-year averages over 16%, with the last quarter’s jump of 24% being the most impressive. Also, unique among semiconductor stocks is the fact that NVDA has a debt-free balance sheet. That allows it to explore deals without the stresses of leverage.

All in all, Wall Street definitely likes what it sees. NVDA stock is up a whopping 76% YTD, easily the best performing company in this gallery. One of the most encouraging technical signs is that NVDA got its jitters out of the way early. Since mid-February, it has been a clear path to the moon. Corrections along the way have been mild, merely a series of sideways consolidations before accelerating skywards.

With momentum so strong, there’s not much to do other than to enjoy the ride.

As of this writing, Josh Enomoto did not hold a position in any of the aforementioned securities.