Last week’s market rebound may be bringing all the bulls to the yard, but I suspect their optimism is premature. The principal problem with buying equities with abandon is the heap of resistance looming overhead. The weakness in August turned the short-term trend of the S&P 500, the Nasdaq and the Russell 2000 lower.

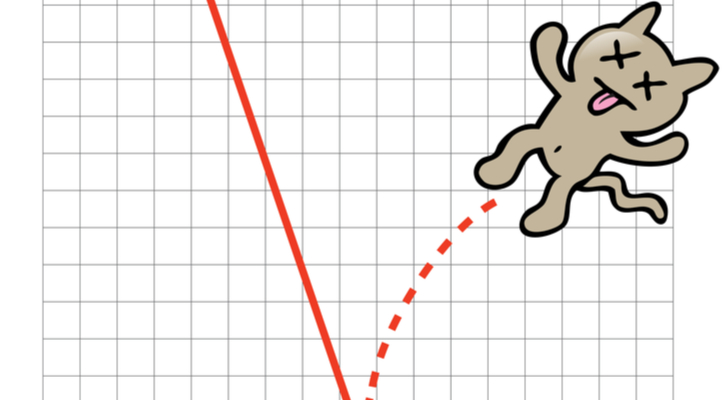

Which has me thinking that last week was a dead-cat bounce! One that sets up more than a few enticing short-selling opportunities.

As charting enthusiasts will attest, the best time to short — and by “best,” I mean when the risk is low relative to the potential reward — is when a stock locked in a downtrend has rallied back multiple days to test overhead resistance. These pops are often “sucker” rallies destined for failure.

My weekend scanning found three such dead-cat bounces that are primed for short sellers. Let’s take a look.

Dead-Cat Bounces to Sell Short: Starbucks Corporation (SBUX)

Ever since getting whacked on earnings, Starbucks Corporation (NASDAQ:SBUX) shares have been floundering. SBUX finds itself submerged beneath the 200-day and 50-day moving averages. And though last week’s dead-cat bounce was able to carry the stock back above the 20-day moving average, it’s a rally made for short selling. Resistance at $54.75 is thus far proving impenetrable.

And though last week’s dead-cat bounce was able to carry the stock back above the 20-day moving average, it’s a rally made for short selling. Resistance at $54.75 is thus far proving impenetrable.

And then there’s the risk-reward. With SBUX sitting near resistance, short sellers can make a swift exit if wrong. And if that stock falls back to prior support at $52.50 we’re looking at a potential profit that’s potentially double the risk.

Short SBUX with a stop above $54.80.

Dead-Cat Bounces to Sell Short: Ford Motor Company (F)

Click to Enlarge

Ford Motor Company (NYSE:F) shares have been driving southbound for the past three years. And they’ve lost 40% of their value in the process. Last month’s slide carried F to a new 52-week low on heavy volume. And that makes me think the recent rally is a ruse. The 200-, 50- and 20-day moving averages are all descending, which confirms bears are in complete control on all time frames.

That makes me think the recent rally is a ruse. The 200-, 50- and 20-day moving averages are all descending, which confirms bears are in complete control on all time frames.

Right now the stock is struggling to get back above the 20-day. This morning’s reversal is creating a potential bearish engulfing candlestick suggesting the next downswing is starting.

Short F stock with a stop loss above $11.

Dead-Cat Bounces to Sell Short: Eli Lilly and Co (LLY)

Click to Enlarge

For our final pick, we’re turning to the healthcare sector. Eli Lilly and Co (NYSE:LLY) shares are forming a classic dead-cat bounce pattern. Two weeks ago, LLY broke below critical support on heavy volume.

The price drop carried the stock to the lower end of its six-month trading range before buyers finally stepped in. And with last week’s rally, LLY stock is now testing the underside of its 200-day moving average. If the upper wick of Friday and today’s candles prove prescient, sellers are about to take control once more.

The price drop carried the stock to the lower end of its six-month trading range before buyers finally stepped in. And with last week’s rally, LLY stock is now testing the underside of its 200-day moving average. If the upper wick of Friday and today’s candles prove prescient, sellers are about to take control once more.

Short LLY below Monday’s low ($78.73) with a stop loss above $79.65. Consider the prior support near $77 your target.

As of this writing, Tyler Craig did not hold a position in any of the aforementioned securities. Want to learn how to master the art of option selling for high-probability cash flow? Check out Tyler’s recently released video series through Tackle Trading on how to systematically sell iron condors for monthly income.