In the current state of the tech world, Alphabet Inc’s (NASDAQ:GOOGL) Google makes almost all of its revenue from selling ads. Google is trying to diversify, by selling hardware like the Pixel smartphone. Apple Inc. (NASDAQ:AAPL), on the other hand, is dominated by hardware revenue –especially iPhone sales. The company is also trying to diversify, looking to Services revenue as a cushion against slowing smartphone demand to protect that sky high AAPL stock.

According to the Wall Street Journal, that effort now includes an active push toward Google’s strong point, with a focus on boosting ad revenue.

WSJ: Apple Working to Boost Ad Revenue

The Wall Street Journal reports that Apple is actively exploring the possibilities for expanding ad revenue, in partnership with app publishers.

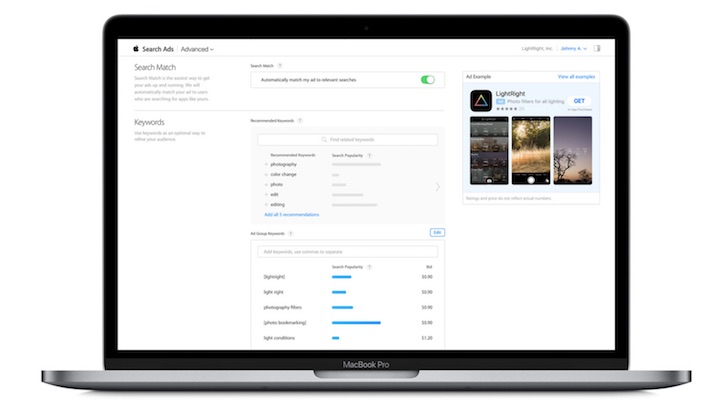

The ad network would take a search from within an iOS app, then display ads based on that search criteria across other participating apps. The app publishers and Apple would split the advertising revenue that’s generated. According to the WSJ report, Apple has been in talks with a number of app publishers about the scheme, including Pinterest and Snap Inc (NYSE:SNAP).

Given that existing advertising based on searches in the App Store generated over $1 billion in revenue for Services revenue for the company in 2017, the potential is there to expand that take.

Services Revenue Key to Diversification for Apple

Many of the big technology giants are scrambling to diversify their revenue sources.

No-one wants to be dominant based on just one aspect of the tech world, then have that market mature or disappear. Diversification helps to protect against bumps, cycles and the potential loss of that primary revenue source — but that often means competing more directly against each other.

The vast majority of Google revenue comes from selling ads and that company has been pushing hardware in a big way, with the goal of diversification. Its Pixel smartphones put it in direct competition with the iPhone, while Google Home smart speakers are now the primary competition for Amazon.com, Inc.’s (NASDAQ:AMZN) Echo smart speakers.

AAPL is in a different position from Google, as its primary revenue driver is hardware — especially smartphones.

Apple has often positioned itself against companies that profit from digital advertising, but the maturing smartphone market has the company worried about slowing iPhone sales. It’s been positioning Services revenue as a way to cushion itself against hardware sales cycles and that effort is paying off with Services becoming an increasingly important factor for the company and for AAPL stock. That Services revenue is already the second highest among AAPL divisions — nearly $9.2 billion in Q2 — but it still has a long way to go before it comes anywhere near the $38 billion the company raked in for iPhone sales in the same quarter.

Potential Risk

There is always risk involved in diversification. For AAPL, that includes annoying consumers with advertising, and looking a little hypocritical given its recent stance on targeted ads. The company has also struggled in the past when it comes to monetizing advertising. It launched iAd back in 2010, but that mobile advertising platform struggled despite slashed rates. Apple closed it down in 2016.

Despite the risks, there’s no arguing with the math. Apple may be generating more iPhone revenue thanks to the bigger ASP of the iPhone X, but the days of AAPL stock surging because of repeated quarters of record smashing iPhone sales are probably over. Services revenue is the company’s best bet to wean itself off that hardware revenue reliance.

On top of Apple Music, app sales and Apple Pay, having a meaningful ad revenue stream in the mix would go a long way toward helping AAPL’s goal to diversify.

As of this writing, Brad Moon did not hold a position in any of the aforementioned securities.