My dear readers, please prepare yourselves – because the impending changing of the guard at the Federal Reserve could redefine where capital flows for the next decade.

Soon, the notion of a central bank solely concerned with inflation and unemployment may give way to one increasingly entangled with national competitiveness and technological power.

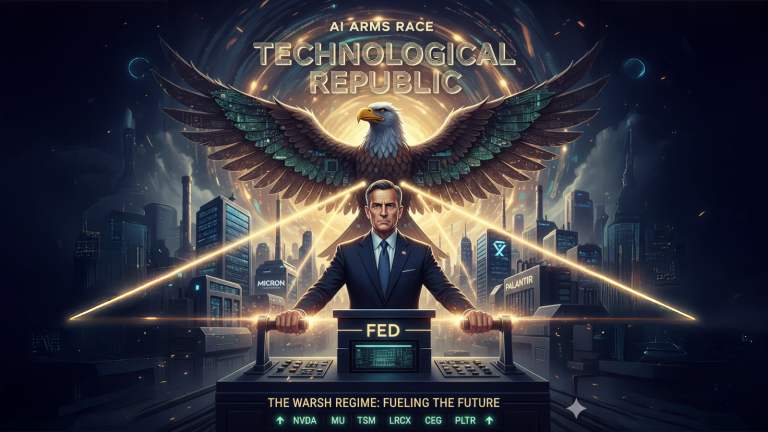

We are entering an era where the Fed’s mandate stretches beyond price stability into something more audacious and existential: winning the AI Arms Race and forging America into a “Technological Republic.”

For decades, Washington has been a slow, reactive beast, forever lagging behind Silicon Valley’s breakneck pace. AI is changing that dynamic – because it is no longer just a technology. It is a national imperative.

And Kevin Warsh – former Fed governor and potential successor to Jerome Powell as chair – is poised to be one of its chief architects.

This represents a regime change in the deepest sense. It’s about aligning the commanding heights of monetary policy with the grand strategic vision of a nation betting its future on computational supremacy.

To understand why Warsh matters so much, you have to understand what the Fed has quietly been doing for the better part of the last decade – and why that era is running out of road.

Why Fiscal Dominance Is Breaking Down

I’ll be blunt: the era of “fiscal dominance” – where monetary policy served fiscal needs by suppressing borrowing costs and absorbing government debt – is likely on its last legs. The math is becoming unworkable.

The United States now carries roughly $35 trillion in national debt, with interest payments approaching $1 trillion a year and rising fast. That trajectory is unsustainable – and it’s exactly why President Trump is looking to Kevin Warsh for help.

Warsh is a structural hawk with a vision. His critique of the Fed’s bloated balance sheet isn’t just about fiscal righteousness; it’s about capital allocation. He views the Fed’s easy money policies as an inefficient, even destructive, siphoning of capital into unproductive ventures, essentially subsidizing “zombie companies” – firms kept alive by cheap credit despite weak productivity or profitability – while steering cash away from true innovation.

His proposed solution: Tough love for Uncle Sam.

By shrinking the Fed’s balance sheet and refusing to function as the Treasury’s ATM, Warsh would raise the marginal cost of debt and force fiscal trade-offs that easy money previously masked. In practice, that pressure pushes Washington to reallocate spending toward genuine productivity gains – read: AI.

This is where the “Technological Republic” comes into full view.

The White House, understanding the urgency, isn’t waiting for the Fed to do all the heavy lifting via rate cuts. We’ve seen the beginnings of this with initiatives like Project Stargate, the government-backed venture capital fund funneling billions into dual-use AI companies that promise both commercial profit and strategic advantage. Similarly, the Genesis Mission, a bipartisan initiative, seeks to de-risk investments in critical AI infrastructure – from advanced fabs to high-capacity data centers – through grants, tax incentives, and even direct state-backed equity in promising ventures.

We can call this 21st-century industrial policy AI Accelerationism. In practice, it means the state actively de-risking early investment so private capital can scale AI faster than markets would on their own.

And under Warsh, the Fed is positioned to become its primary enabler.

How a Warsh-Led Fed Could Accelerate AI Investment

So, what tangible actions could a Warsh-led Fed take that would send a direct current of capital into the AI supply chain?

What Kevin Warsh Has Said About AI and Productivity

Warsh has loudly proclaimed that AI is a “significant disinflationary force.” This is a radical reframing of monetary policy.

Historically, strong growth prompted the Fed to raise rates to cool inflation. Warsh’s argument is different: if growth is driven by productivity – doing more with less – then inflation is not necessarily the byproduct, even in a hot economy.

If that logic shows up in the data, it opens the door to more flexible rate policy. Lower rates in a productivity-driven expansion dramatically reduce the cost of capital for the multi-billion-dollar investments required to build fabs, data centers, and the energy systems that power them.

In other words, cheaper money, aimed at the economy’s most powerful growth engine.

Why Less Financial Engineering Means More Productive Growth

Warsh is no fan of the post-2008 banking regulations that, in his view, stifle lending to innovative, growth-oriented businesses. He’s argued that current rules favor large, incumbent banks and hinder credit flow to the agile firms that actually drive technological progress.

So, we may expect a push to streamline some regulations and perhaps even recalibrate capital requirements for regional banks willing to lend to the crucial mid-cap tech and energy companies building out the AI backbone. This unlocks a new tier of financing for those critical, yet often overlooked, players in the AI supply chain.

Forward Guidance for an Innovation-Driven Economy

The Fed communicates its intentions through “forward guidance” – explicit signals about how policy is likely to evolve. Under Warsh, we think this guidance would pivot sharply from being solely “data-dependent” (i.e., reacting to last month’s inflation figures) to becoming “future-focused” and “growth-centric.”

The Fed would signal a long-term commitment to fostering an environment where innovation thrives, providing the market with the confidence to make five- to 10-year capital commitments in AI. This stability could be like rocket fuel for venture capitalists and private equity funds looking to deploy massive sums into long-cycle AI projects.

All of this sounds abstract – until you ask the only question that actually matters: where does the money go next?

What This Means for Investors

This isn’t just about buying Nvidia (NVDA) – though its position at the center of AI compute remains unrivaled. This is about recognizing that the “Technological Republic” needs physical infrastructure: the shovels to build data centers, the picks to extract insights, and the power grids to run the entire system.

The Silicon Chokepoints Powering the AI Economy

This may be the obvious starting point; but the Warsh regime supercharges it. Lower cost of capital means companies like Nvidia can continue to command premium prices, and their customers (Hyperscalers, Enterprises) can afford to buy more. But look deeper:

- Micron (MU): HBM is no longer optional for frontier AI models – it is a gating factor – which gives memory suppliers unusual pricing power. With HBM3E capacity effectively sold out and demand exceeding supply, memory makers enjoy unusual pricing power. Access to cheaper capital enables faster fab expansion to meet structurally rising demand.

- Taiwan Semiconductor (TSM): No domestic alternative currently exists at scale, making TSMC a de facto strategic supplier regardless of reshoring ambitions.

The Companies That Build the AI Factories

These are the machines that make the machines. If Warsh is pushing for aggressive AI infrastructure buildout, then these companies are non-negotiable. Every dollar spent on new AI fabs ultimately flows through this group.

- ASML (ASML): The firm’s Extreme Ultraviolet Lithography (EUV) machines are the only way to make sub-3nm chips. Record bookings are already flowing in, signaling massive future fab investments.

- Lam Research (LRCX) and Applied Materials (AMAT): Essential providers of etch, deposition, and process tools – direct beneficiaries of expanding memory and logic capacity.

- Nova Measuring Instruments (NVMI), MKS Instruments (MKSI), Entegris (ENTG): Specialized suppliers of metrology, vacuum systems, and materials that scale directly with fab construction.

Energy Infrastructure Becomes a Strategic Asset

AI is electricity-hungry. A Fed aligned with national AI priorities would be incentivized to treat energy infrastructure as a strategic asset.

- Constellation Energy (CEG) and Vistra (VST): Owners of nuclear and gas generation capable of providing the stable baseload power hyperscale data centers require. Both are already signing long-term power purchase agreements with AI customers.

- Eaton (ETN): A critical supplier of power distribution, grid modernization, and data-center electrical infrastructure. If you’re building AI capacity, you’re buying Eaton equipment.

- NextEra Energy (NEE): The largest renewable producer and a major player in transmission and storage – essential as AI demand strains existing grids.

- Small Modular Reactors (SMRs): Still early, but distributed nuclear power remains a long-term solution for AI data centers, and one likely to attract public and private capital under this regime.

Where AI Profits and National Security Overlap

Warsh’s affinity for the Silicon Valley–national security nexus favors companies building AI for both commercial efficiency and defense.

- Palantir (PLTR): Its contracts are long-duration, mission-critical, and often inflation-protected – precisely the kind of revenue stream markets reward in a higher-discipline regime.

- Smaller, specialized AI defense contractors: Keep an eye on these. Capital will seek them out, especially with initiatives like Project Stargate providing early funding.

The Investment Case for America’s Technological Republic

The impending Warsh Regime is not just another chapter in Fed history. It’s the institutional recognition that America’s future hinges on its AI prowess – and monetary policy is a tool to accelerate, not merely manage, this transformation.

Markets are starting to wake up. But the full implications – a sustained, government-backed, Fed-enabled acceleration of the AI supply chain – are not yet fully priced in.

As capital pivots away from the debt-laden past, ask yourself: is your portfolio positioned to benefit from a Fed that funds the future, not one that rescues the old economy?

If the Warsh era marks the Fed’s pivot from stabilizing the old economy to financing the new one, then the U.S. government’s Genesis Mission is where that shift becomes investable.

Much like the Manhattan Project or Apollo Program, Genesis is a public-private mobilization – this time aimed squarely at winning the AI race against China. And unlike those historic efforts, today’s markets don’t take decades to price winners. They compress gains into months.

On Feb. 22, the government will begin revealing where the money, contracts, and strategic support are going. That creates what I believe is a narrow, roughly 30-day window to position ahead of the eight companies best aligned with this effort – before Wall Street fully connects the dots.