During October’s market selloff, the chip sector has experienced some of the worst selling pressure. Just look at the drops in the stocks of companies like Micron Technology (NASDAQ:MU), Texas Instruments (NASDAQ:TXN),Western Digital (NASDAQ:WDC), and NVIDIA (NASDAQ:NVDA). Although the latter company is one of the leaders of the chip sector, NVDA stock has dropped about 30% in the last month.

A major catalyst of the bearishness has been the trade tensions between the U.S. and China. That makes sense, since many chip companies rely on extensive supply chains in Asia.

But another reason for the weakness is that some Wall Street analysts, citing adverse supply and demand trends in the chip sector, have recently posted negative reports about the space. Such warnings have been issued by top firms like Goldman Sachs (NYSE:GS) and Morgan Stanley (NYSE:MS

).

While all this is certainly worrisome, could the worries be overdone? Perhaps the valuations of the sector’s stocks already reflect much of the bad news.

All in all, it’s tough to tell. But for investors evaluating opportunities, the best approach is to focus on leading companies such as Nvidia. And recently, Nvidia stock has shown some traction, as NVDA stock has surged about 17% since late Monday afternoon.

A report by JPMorgan (NYSE:JPM) analyst Harlan Sur has provided a positive catalyst for NVDA stock. Sur upgraded NVDA stock from “neutral” to “overweight,” with a price target of $255. That implies upside of about 22% from current levels.

Sur believes that NVDA is likely to gain a great deal of market share. According to the analyst: “Despite the potential for a near-term gaming GPU slowdown, we believe the company’s HPC [high-performance computing]/professional visualization/datacenter momentum remains strong as new compute workload acceleration (AI/deep learning, analytics, etc.) penetration remains solid.”

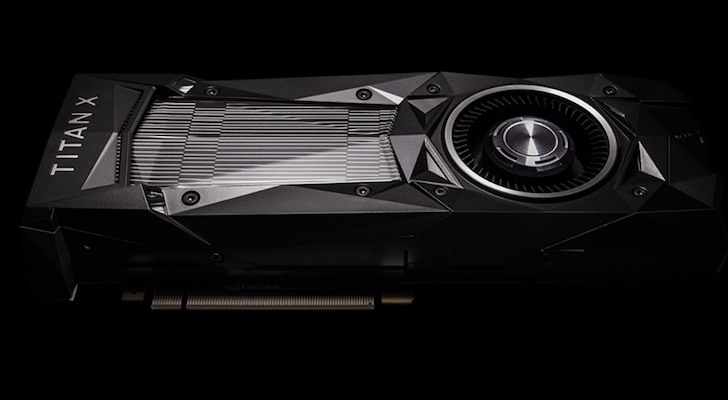

I think that analysis is spot-on. At the core of NVDA is its GPU technology, which has proven to be ideal for cost-effectively handling data-intensive and complex functions like AI (Artificial Intelligence), VR (Virtual Reality) and AR (Augmented Reality).

Also key for Nvidia stock is the fact that the company has created a diverse business around this technology.

Granted, gaming is still the company’s largest business, as it generated $1.8 billion of revenue in the third quarter. But the business is still growing quickly. In Q3, its revenue jumped 52% year-over-year basis and 5% sequentially. More importantly, the business should continue growing for some time. Some of its drivers include eSports, Fortnite’s “battle royale” genre, and the trend towards cinematic graphics.

Next, there is the company’s datacenter business, which is being powered by the megatrend of companies aggressively moving towards the cloud. During Q3, the business’ revenues shot up 83% to $760 million. It’s important to note that customers want technologies that enable real-time AI services like voice recognition, recommendations and search.

Finally, the company’s automotive business, which generated revenue of $161 million in Q3, is still relatively small, but it could grow rapidly in coming years. NVDA’s platform for autos is called DRIVE Pegasus, which can crunch a staggering 320 trillion operations per second.

The Bottom Line on NVDA Stock

The forward price-earnings multiple of Nvidia stock has dropped to 26. That valuation is certainly reasonable in light of the company’s long-term growth prospects.

Of course, Nvidia stock could still drop further. As we saw in the wake of Advanced Micro Devices’ (NASDAQ:AMD) results, Wall Street has not been kind to companies that miss expectations.

But then again, Nvidia has a much larger business and is growing much faster than AMD. Besides, NVDA has a solid track record when it comes to earnings expectations. In other words, the recent decline of NVDA stock appears to have created a fairly decent entry point, especially for those investors who want to get exposure to some of the most important next-generation technologies.

Tom Taulli is the author of High-Profit IPO Strategies, All About Commodities and All About Short Selling. Follow him on Twitter at @ttaulli. As of this writing, he did not hold a position in any of the aforementioned securities.