The semiconductor industry is undergoing a massive transformation in 2023, driven by the demand for faster, smarter and more energy-efficient chips. One of the key drivers of this change is the emergence of conversational artificial intelligence (AI), which enables natural and seamless interactions between humans and machines. ChatGPT uses custom-designed chips from some of the top semiconductor companies in the world, creating a symbiotic relationship between the AI and chip sectors. In this article, I will explore three semiconductor stocks that are poised to power the next chip revolution and benefit from the growth of conversational AI.

Advanced Micro Devices (AMD)

Advanced Micro Devices (NASDAQ:AMD) needs little introduction at this point. The global leader in high-performance computing, graphics and visualization technologies has had a good year in terms of stock price appreciation as investors bet on the firm’s role in AI computing. However, as things stand currently, AMD still remains behind Nvidia’s (NASDAQ:NVDA) breakthrough A100 and H100 chips that power conversational AI bots like ChatGPT.

However, like I have stressed in prior articles, investors should not count AMD out even though it has yet to commercialize its MI300x GPUs. What the chipmaker has indeed been able to do throughout the past decade is challenge Intel’s dominance in CPU market, and that can be replicated in the GPU space. The company reported Q3’2023 earnings last week and beat Wall Street estimates, while also announcing the company expects to sell $2 billion in AI chips next year. AMD’s have since then rallied more than 13.5%, and eager investors should buy in now before shares rise even further.

Taiwan Semiconductor Manufacturing Company (TSM)

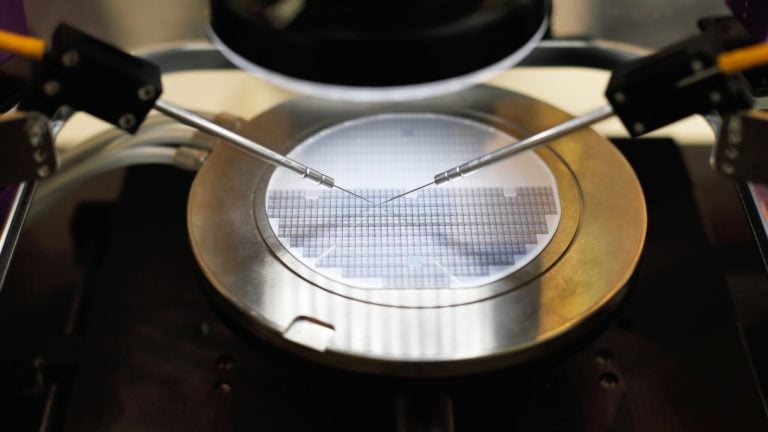

TSMC (NYSE:TSM) is the world’s largest contract chipmaker and has to be a part of the portfolio of any investor betting on the next chip revolution. The contract chip manufacturing produces chips for clients such as Apple (NASDAQ:AAPL), Qualcomm (NASDAQ:QCOM), and Nvidia. TSMC specializes in advanced manufacturing processes, such as 5-nanometer and 3-nanometer technologies, which enable smaller, faster and more power-efficient chips. Due to its competencies in chip manufacturing, TSMC also plays a key role as a supplier of AI chips for ChatGPT.

In their recent earnings report, TSMC, not only boosted revenue guidance but also noted the chip slump appeared to be coming to an end. This could spell good news for the coming year in terms of financial performance and valuation multiple expansion. Right now, TSMC shares trade at an attractive multiple of 15.3 times forward earnings, which is below many of its semiconductor counterparts.

ON Semiconductor (ON)

ON Semiconductor (NASDAQ:ON) or “Onsemi” is a leading provider of power management, analog, sensors, logic, timing, connectivity, discrete and custom devices. The company serves a diverse range of markets, including, industrial and consumer electronics, but its main focus in recent years has been power efficient solutions for electric vehicles, smart homes and IoT devices.

The semiconductor firm’s exposure to consumer electronics and IoT end-markets have definitely caused a slowdown in top-line growth as there has been a general pullback in consumer spending on electronics since the height of the pandemic. Onsemi’s sluggish quarterly revenue growth in 2023 is a reflection of this recent spending dynamic. However, the firm’s electric vehicle segment could be a bright spot in the coming years as consumers increasingly consider electric vehicles over combustion engine vehicles. ON shares trading at only 14.7 times forward earnings is the icing on the cake.

On the date of publication, Tyrik Torres did not have (either directly or indirectly) any positions in the securities mentioned in this article. The opinions expressed in this article are those of the writer, subject to the InvestorPlace.com Publishing Guidelines.