One of the greatest investors of our time is Peter Lynch. He took Fidelity Magellan from $20 million in assets under management (AUM) in 1977 to $14 billion AUM in 1990 when he retired, a 29% annual average return over that period. This has led us to create this list of under-the-radar stocks for investors.

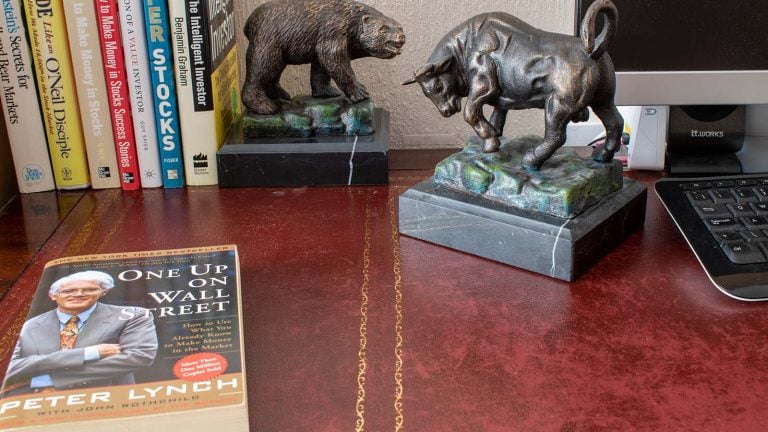

Lynch also wrote two of the best value investing books that distilled his simple investment philosophy into an accessible medium. “One Up on Wall Street” and “Beating the Street” are still important investment guides any investor can use today.

In short, Lynch didn’t want to overpay for stocks, preferring to buy them at a discount. Yet he wanted businesses that exhibited financial discipline and saw profits grow over time. He also liked looking in out-of-the-way spots for his stock picks. Below are three Peter Lynch stocks that seem to tick all the boxes. Let’s find out if they’re right for your portfolio.

Cactus (WHD)

Cactus (NYSE:WHD) is a small but growing player in the oilfield services industry dominated by the likes of Baker Hughes (NYSE:BKR), Halliburton (NYSE:HAL) and SLB (NYSE:SLB). While it sells pressure control equipment for wellheads, recent periods have seen the oil and gas industry reduce the number of rig counts in operation despite soaring prices.

That’s the new economics of the industry. Drillers like Exxon Mobil (NYSE:XOM) and Chevron (NYSE:CVX) are limiting capital expenditures to maintain profitability instead of going through a boom-and-bust cycle. Now they focus on their most profitable fields while seeking more measured expansion.

In the most recent survey, Baker Hughes reported 617 rigs in operation, three fewer than the week before and 131 less than last year. West Texas Intermediate (WTI) crude sells for $84 a barrel today, 6% above last year’s price.

To compensate for these kinds of swings, Cactus acquired FlexSteel, a manufacturer of spoolable pipe technologies. It diversifies Cactus’ operations while offering significant growth potential because of the complementary services it provides with Cactus’s legacy product line and the inroads it has already made with industry majors.

At just 15 times next year’s earnings estimates, a fraction of Wall Street’s estimated earnings growth rates and just 11x the free cash flow Cactus produces, this is a stock that Lynch could love. If you are looking for under-the-radar stocks, start here.

Hudson Technologies (HDSN)

I’ve been watching Hudson Technologies (NASDAQ:HDSN) for some time now, and though early in my call on the inflection point for the stock (read, wrong), I still believe it is imminent.

Hudson is the biggest player in the green refrigerant market with a 35% share. In 2020, Congress enacted the American Innovation and Manufacturing Act, a law that phases out virgin hydrofluorocarbons (HFCs), so-called greenhouse gases that contribute to supposed global warming. By 2036, the federal EPA wants HFCs to be reduced by 85%. That forced reduction is going to lead to shortages of popular refrigerants like R-410A and R-134a could surface, affecting prices. The former is one of the most popular refrigerants in the country and is typically used in a home’s central air conditioning system. The latter is used in most automobile AC systems.

That’s where Hudson Technologies comes in. As the law cuts into available supplies, demand for reclaimed refrigerants will grow. Hudson saw business spike when the law was first enacted, but saw the fear gradually subsided when refrigerants didn’t immediately evaporate. Because it is a phased-in law, the hysteria will mount once more as greater swaths of supply are removed from the market. Hudson stock should grow alongside the return of the industry’s mounting concern.

The stock trades at eight times earnings estimates, at a fraction of earnings growth rates and just 8x FCF. Hudson isn’t a household name yet but because of the government’s actions, it likely will be soon. This is easily one of the top under-the-radar stocks.

JD.com (JD)

Okay, JD.com (NASDAQ:JD) isn’t the most obscure name in stocks but because it is an e-commerce platform in China it isn’t front-of-mind with most people the way Amazon (NASDAQ:AMZN) is. It also trades at massive discounts that are tough to ignore particularly with some large catalysts approaching.

JD and sister online retailer Alibaba (NYSE:BABA) saw their shares crumble under relentless government attacks on technology stocks. The ongoing sluggishness of the Chinese economy also weighed heavily on their shares. Yet Beijing finally relented in its pursuit of corruption and is pushing for stimulus programs to bolster consumers. Bloomberg reports the government’s budget plan for the coming year holds an even bigger stimulus package than many expect.

That could be perfect timing for JD.com’s annual 618 annual shopping extravaganza. Named for the company’s founding (June 18), last year it ran from the end of May to mid-June. Think of it as Amazon Prime Day on steroids. Analysts estimate JD sold around $60 billion worth of merchandise last year. It should launch again in the next month or so.

JD.com stock goes for just seven times earnings estimates, a fraction of earnings growth estimates and an even smaller fraction of sales. This just might be the biggest no-brainer Peter Lynch stock on the list. Improve your portfolio with these under-the-radar stocks.

On the date of publication, Rich Duprey held a LONG position in XOM and CVX stock. The opinions expressed in this article are those of the writer, subject to the InvestorPlace.com Publishing Guidelines.