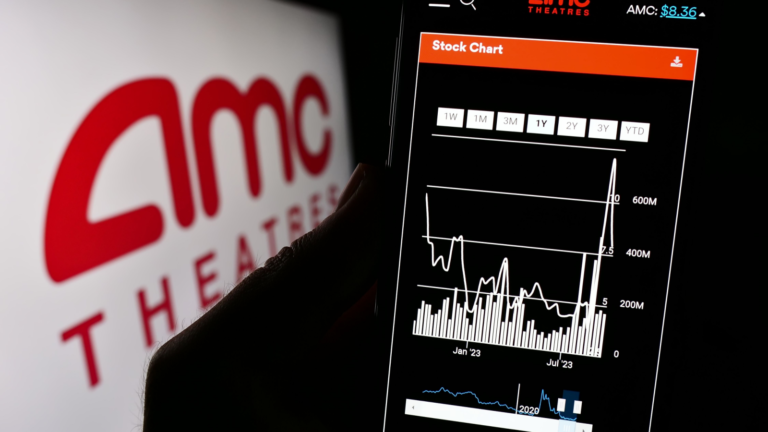

It’s too bad for AMC Entertainment (NYSE:AMC) bulls that investors can’t live in a bubble. If they could, they would lock in the 45% gain for AMC stock over the past month.

Sadly, we don’t live in a bubble, and AMC stock isn’t a five-star investment. It’s the exact opposite. It’s a dud, but not because it is a movie theater chain; its shareholders refuse to read the tea leaves about the future.

This past Memorial Day weekend, the movie box office was abysmal, generating $128 million in ticket sales over the four days, 37% less than in 2023 and the lowest number since before the turn of the century.

Furiosa, the fifth installment of the Mad Max franchise, earned $32 million at the box office between Friday and Monday, the worst performance by a number-one film since Casper, released in 1995.

The holiday weekend’s box office disaster is another reason AMC stock is radioactive. If you’re smart, you’ll stay away. Here’s why.

The Problem With the Movie Theater Business

Three groups make the movie exhibition industry tick: operators like AMC, real estate owners such as EPR Properties (NYSE:EPR), and movie studios, independent filmmakers, and their distributors. While all three have positive aspects, they also have apparent negative aspects that can hurt your return on investment.

Let’s start with the studios and work backwards to AMC.

It costs a bundle to make movies. If it were easy to make money filmmaking, there would be a lot more filmmakers. According to the Indy Film Library, about 40% of studio releases in the U.S. make some profit, while less than a third of independent films do so.

For this reason, the studios supported by massive companies like Walt Disney (NYSE:DIS) tend to favor big box office films like Star Wars, where the profits are large enough to make the big budgets worthwhile.

Real estate owners like EPR own movie houses because lease revenues are generally stable, except during pandemics, and it’s relatively easy to get funding to build these 10-20-screen complexes.

The downside is that real estate isn’t very flexible. If movies aren’t cutting it, what will you put in its place? Offices? That was sarcasm. Fitness Club? Maybe. Retail? Also, maybe. The list of maybes goes long.

Lastly, you have the movie exhibitors. They rely on real estate owners and film producers to keep the box office rolling. Without either of them, their businesses become far more hamstrung, unlikely to survive.

It would be better if movie theaters banded together into a cooperative to own and show movies where profit was an afterthought.

That isn’t happening in the good old USA.

Movie History Hurts AMC Stock

Imagine that I offered you the opportunity to open a restaurant in your hometown in the finest location within 50 miles. The only caveat is that the beverages you would buy to serve your customers would have to be my choosing. You would have no control over what is served. It could all be crappy, and you’d be stuck with it.

Most sane people would say, “Thanks, but no thanks.”

Well, that’s what happens in the movie exhibition business.

Despite having over 10,000 screens in the U.S. and overseas, AMC still operates under the thumb of the big movie studios and the distributors they work with to get films into theaters.

The name of the game for the studios is to make as much money as possible from the movies they produce. If Disney thinks the latest Star Wars film will do big box office, it might make 60% or more of the opening weekend box office and then less of a share as the weeks go by and the number of moviegoers falls.

However, every film is different.

Until the 1948 Supreme Court decision in United States v. Paramount, which ruled that the vertical integration business model operated by Paramount and other big studios—which included owning the movie theaters—violated U.S. antitrust laws, the studios were forced to sell off their theaters.

At the end of the day, while the studios can’t force AMC to show certain movies, it has to play ball if they want to get the best films available.

The problem is that when you’ve got declining attendance — S&P Global Market Intelligence data shows that only 15% of Americans go to movies more than once a month, down from 23% in 2019 — it becomes even more critical for theaters to get box office winners.

More often than not, they’re produced by the big studios. When they’re duds like Furiosa, it makes it very difficult to make money.

AMC stock remains a big sell.

On the date of publication, Will Ashworth did not have (either directly or indirectly) any positions in the securities mentioned in this article. The opinions expressed in this article are those of the writer, subject to the InvestorPlace.com Publishing Guidelines.