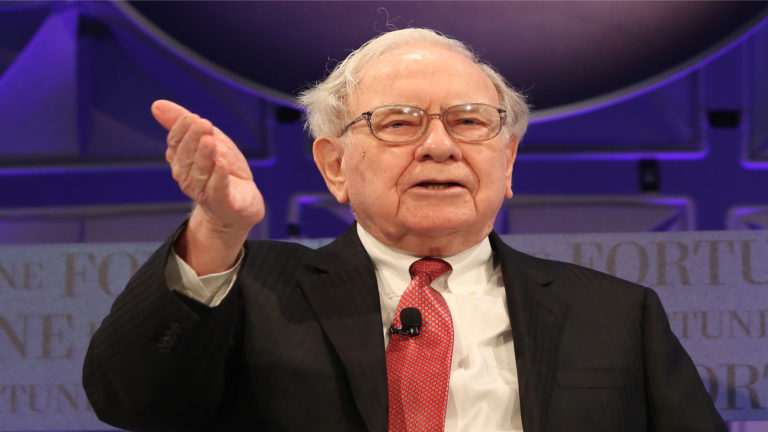

The stock market is an effective means of building wealth over a significant period of time,. However, that doesn’t mean that stocks only go up. In fact, even the top Warren Buffett stocks for a bear market get beaten up from time to time.

That said, over the very long term, patient investors are likely to benefit from the compounding effects of the market. That’s because, despite the market’s ups and downs, stocks have always risen over time.

Given the current macroeconomic environment, even the holdings of Warren Buffett’s Berkshire Hathaway (NYSE:BRK.B) portfolio are under pressure. That said, although Buffett isn’t buying many stocks these days, he’s not selling many either.

And Buffett has been aggressively adding oil names (those deals have been timed very well), fortifying his portfolio even more. Let’s dive into seven Warren Buffett stocks for a bear market.

| AAPL | Apple | $140.09 |

| V | Visa | $183.83 |

| TMUS | T-Mobile | $137.59 |

| MA | Mastercard | $294.97 |

| AMZN | Amazon | $114.56 |

| DEO | Diageo | $167.30 |

| CVX | Chevron | $160.03 |

Apple (AAPL)

There are obvious reasons why investors love Apple (NASDAQ:AAPL). However, since AAPL is Buffett’s top holding, he must really love this company.

Buffett has been loading up on Apple stock for years, since he began buying its shares in 2016. Apple has now become by far Berkshire’s largest public stock position. With Berkshire owning more than 915 million shares of the giant, its stake is worth over $130 billion. That’s a massive position, even though it amounts to only roughly a 5.7% stake in AAPL.

However, Buffett’s position in Apple accounts for about 40% of Berkshire’s publicly traded stock portfolio. So when Buffett says that diversification is for suckers, he really means it. In fact, Berkshire’s Apple stake is over four-times as massive as any of the holding company’s other stock positions.

Apple’s most recent quarterly financial results show the strength and loyalty of the company’s consumer base. The firm reported Q2 revenue of $83 billion. While its sales only climbed 2% year-over-year, the $83 billion of sales was still an all-time record and, despite its huge size, Apple is still finding ways to grow.

Buffett’s strong belief in Apple is all most investors need to go full bore on this long-term gem.

Visa (V)

Another stock that both Wall Street analysts and Warren Buffet love is payments leader Visa (NYSE:V). This Warren Buffett stock became a core holding for Berkshire in 2011. Since then, Visa has continued its impressive, long-term run higher.

Since Buffett’s initial investment, the shares of Visa are up over 800%. Many believe that Visa has remarkable business fundamentals and an attractive valuation, which should help the company produce high returns on capital in the long term and raise its operating leverage.

Further, Buffett clearly believes in V stock, as he currently owns roughly 8.3 million shares of V stock. His stake in the credit card network is worth around $1.5 billion.

Visa declared that its U.S. payments volume in August rose 11% year-over-year. Also, the company’s credit payments volume rose 17%, and its debit volume surged 7% YOY. Both of these metrics are up, though marginally, from the previous quarter.

Over the long-term, there are plenty of catalysts that could take Visa higher. The continued growth of cross-border travel and strong global economic activity bode well for the company. Indeed, there’s a reason why many experts are bullish on the medium-to long-term growth prospects of Visa.

T-Mobile (TMUS)

One of the high-profile Warren Buffett stocks that entered Berkshire’s portfolio in 2020 was T-Mobile (NASDAQ:TMUS). At the time, most stocks were in turmoil, and T-Mobile was one of the safe havens that Warren Buffett and many others sought out. Indeed, despite a few small dips, this stock has actually trended mostly higher during the last, volatile couple of years.

Notably, TMUS stock has greatly outperformed the S&P 500 index this year, posting gains of around 27% compared to the index’s return of around -20%.

Admittedly, the valuation of this U.S. wireless provider is not as cheap as that of its competitors. Additionally, T-Mobile does not pay a dividend. And we all know how much Warren Buffett likes his dividends.

Still, some analysts believe that this company is well-placed to outgrow its rivals after its acquisition of Sprint. Plus, many think that T-Mobile’s 5G network is well ahead of its peers in terms of how close it is to being rolled out, providing TMUS with long-term, non-cyclical growth catalysts that are worth considering.

Currently, Berkshire Hathaway holds around 5.2 million shares of TMUS stock. At T-Mobile’s current prices, that’s worth roughly $730 million.

Mastercard (MA)

It has actually been more than a decade since Buffett first invested in credit card behemoth Mastercard (NYSE:MA). In that time, this stock is up roughly 1,260%.

So the investors who followed the Oracle of Omaha into one of the best-performing Warren Buffett stocks out there did remarkably well over the last decade.

A leader in facilitating electronic payments, Mastercard links merchants, customers, financial institutions, corporations, governments, digital partners, and other companies globally.

Recently, Mastercard declared that it would be providing added value to U.S. small business cardholders with new and expanded benefits. Specifically, MA will focus on cyber security, convenience, and efficiency to directly address some of the business’ most pressing requirements.

Many analysts believe that Mastercard’s volume-driven business helps insulate it from choppy consumer spending and inflationary pressures. Additionally, as higher percentages of payments are made with digital methods, Mastercard should get a boost from that trend.

Currently, Berkshire Hathaway holds around 4 million shares of Mastercard. Its MA stock is worth roughly $1.2 billion.

Amazon (AMZN)

There’s a reason why both analysts and Warren Buffett remain very bullish on e-commerce juggernaut Amazon (NASDAQ:AMZN).

Despite concerns about Amazon’s core e-commerce business, Warren Buffett appears to have identified a number of long-term growth catalysts for the conglomerate. Specifically, its advertising business and AWS cloud business are the two key factors that could create sustainable, long-term growth for investors. Indeed, we’re all shopping online more than we did before, thanks to the pandemic. But if we enter a recession, Amazon’s e-commerce business will slow.

However, Amazon’s AWS division will not suffer a similar fate. That’s because companies’ data storage and global computing power needs are only set to rise. And since Amazon is one of the major players in the booming cloud computing sector, there’s a lot to like about the company’s long-term growth outlook.

Berkshire Hathaway’s stake in this megacap tech stock sits at around 10.7 million shares, worth around $1.3 billion. And when Warren Buffett takes such a huge position in a tech stock, investors take notice.

Diageo (DEO)

A leading global spirit and wine producer, Diageo (NYSE:DEO) is a former holding of Warren Buffett. That’s because the Oracle of Omaha divested his stake in the maker of Johnny Walker, Guinness, and other notable spirits brands.

It’s worth looking, however, at DEO stock, in order to determine whether it may be a great long-term bet. After all, if we’re indeed headed into a recession, many folks will likely be drinking more.

It’s true that the alcohol sector stays relatively stable, in good times and bad. This company’s lucrative earnings profile and long-term growth potential are driven by its comparatively resilient business model.

The thesis embraced by DEO stock bulls is that the company will continue to increase its market share. While Buffett appears to be uncertain about this notion, Diageo’s shares are worth considering right now.

Chevron (CVX)

Last, but certainly not least, we have Chevron (NYSE:CVX), an integrated energy company. Warren Buffett has bought a significant amount of CVX stock lately. Indeed, the Oracle of Omaha has shown a penchant for buying energy stocks recently. So it should be no surprise to many that Chevron’s shares have received a lot of attention this year.

Chevron is the second-largest energy company in the U.S. after ExxonMobil (NYSE:XOM). CVX is also one of the world’s largest, multinational, diversified energy firms. The company is active in every stage of refining, retailing and producing petroleum products.

For Berkshire Hathaway, CVX is a relatively new holding. Berkshire first bought Chevron’s shares at the end of 2020. As of Aug. 12, Chevron made up roughly 7.3% of Berkshire’s holdings.

It seems that investors love CVX stock, and there are reasons for that. Its historical, average EPS growth rate is 8.4%. However, investors must focus on the expected growth of its profits this year. Analysts, on average, expect Chevron’s EPS to increase a huge 126% in 2022.

On the date of publication, Chris MacDonald did not have (either directly or indirectly) any positions in the securities mentioned in this article. The opinions expressed in this article are those of the writer, subject to the InvestorPlace.com Publishing Guidelines.