Gold is having a robust performance in 2023.

According to Bank of America‘s commodity strategist Michael Widmer, supply and demand trends indicate that gold prices will likely stay high. Widmer’s model suggests that a small increase in investor purchases could drive prices upward. For most commodity prices, including lithium and other industrial metals, the outlook from many analysts remains fervent.

Admittedly, price volatility has hurt many mining stocks of late. However, the overall trend over the medium-term could be one in which prices generally move up and to the right. Thus, instability can be an investor’s friend. Price swings can create dislocations which can benefit those taking a long-term view on a particular sector or commodity group.

Therefore, for those bullish on precious metals and lithium, let’s delve into three stocks worth backing up the truck on now.

Barrick Gold (GOLD)

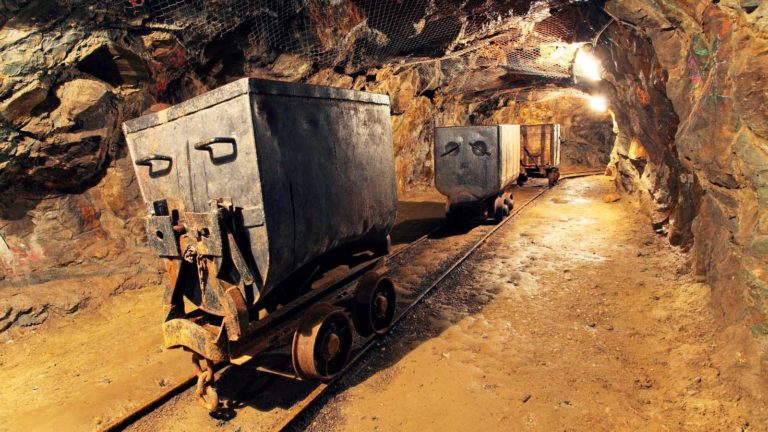

Barrick Gold (NYSE:GOLD), a traditional miner in gold dividend stocks, operates across 16 sites in 13 countries. It has a near $29 billion market cap. Despite a 7% equity value drop this year, it’s worth considering for long-term investors in safe-haven gold stocks. Barrick offers a 2.42% forward yield and a low 34.42% payout ratio.

GOLD’s latest earnings were a mixed bag. They’ve been beating EPS estimates but missing on revenue, with a modest 1.06% net margin and 3.46% return on equity. Institutional investors, holding 55.45% of the stock, are increasing stakes, indicating confidence in the long term.

Barrick Gold consistently exceeds a 100% gold reserve replacement ratio, ensuring reliable cash flow. The company’s valuable copper assets align with growing green energy demands, positioning it for future gains.

Lithium Americas (LAC)

Lithium Americas (NYSE:LAC) stock fell 38% in the past year, creating a clear dip that is an attractive entry point for long-term investors. The recent shareholder approval for the U.S. and Argentina business split could unlock value not yet reflected in the stock price.

In recent news, a significant lithium deposit was found within a dormant volcano on the Nevada-Oregon border. Lithium Americas’ stock surged approximately 10% on this news. The company owns the Thacker Pass mine in Nevada, one of the largest approved mines in the U.S. Also, it has secured refining agreements, a crucial development for the American lithium mining sector. If Lithium Americas gains rights to this discovery, it could significantly enhance its future prospects.

We’ll have to see how everything plays out. Lithium supply and demand fundamentals may or may not be pushed out of whack as a result of this news. For now, it appears investors are taking a more bullish view on lithium stocks, which is a good thing for this leading miner.

Newmont Mining (NEM)

Newmont (NYSE:NEM) offers potential for robust dividend growth. NEM features an attractive forward price-earnings ratio of only 14-times and a 4.1% dividend yield. The gold market appears primed for growth amid geopolitical tensions and increasing global debt. It may potentially reach $2,500 to $3,000 per ounce in the near future.

Gold can thrive in various scenarios, not just inflation. Newmont is expected to grow earnings by 35% in the next year, leading to a 50% higher consensus price than its recent closing price. The company is expected to provide significant growth over the long-term, though some estimates do suggest a dip could be coming. Also, importantly, this stock at 14-times earnings.

Newmont recently received approval from the Australian Competition & Consumer Commission (ACCC) for its acquisition of Newcrest Mining. The ACCC will inform Australia’s Foreign Investment Review Board for further consideration. The deal is also awaiting other regulatory approvals and is set to close in Q4. Korea’s Fair Trade Commission and Papua New Guinea’s (PNG) Independent Consumer & Competition Commission have previously cleared the acquisition, along with Canada’s Competition Bureau in July.

On the date of publication, Chris MacDonald did not have (either directly or indirectly) any positions in the securities mentioned in this article. The opinions expressed in this article are those of the writer, subject to the InvestorPlace.com Publishing Guidelines