Earlier this week, Matthew Tuttle’s Tuttle Management filed to create two new exchange-traded funds (ETFs) to track the activity of CNBC’s Mad Money host Jim Cramer. The first, called the Inverse Cramer ETF, will carry the symbol SJIM and bet against stocks recommended by Cramer. The ETF will be active and will use short positions or derivatives to bet against the stocks.

The second ETF is called the Long Cramer ETF and will carry the ticker symbol LJIM. LJIM will be the opposite of SJIM and will take a long position in stocks recommended by Cramer.

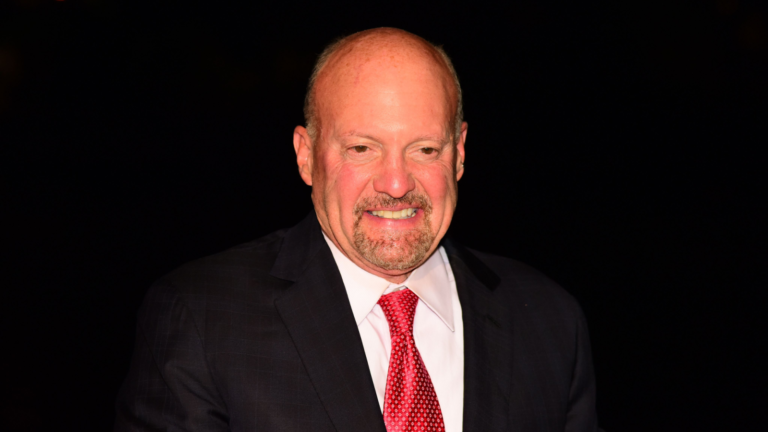

Cramer is a well-known financial personality and has made several questionable recommendations in the past few years. Because of this, investors love to poke fun at his recommendations and instead do the opposite of what he says.

Meanwhile, Matthew Tuttle sprang into the mainstream investing world following the release of AXS Short Innovation Daily ETF (NASDAQ:SARK). SARK is an actively managed ETF that seeks to provide an inverse return to the ARK Innovation ETF (NYSEARCA:ARKK). Shares of SARK are up about 60% this year as ARKK’s investments have plunged lower.

Short These 10 Stocks Using the Inverse Jim Cramer Strategy

Both LJIM and SJIM are still seeking approval and are not yet available. However, Quiver Quant offers a strategy that is similar to SJIM. The Inverse Cramer Strategy takes a short position in Cramer’s top ten recommended stocks, whether bullish or bearish, over the past month. The strategy rebalances on a weekly basis and also takes a long position in the SPDR S&P 500 ETF Trust (NYSEARCA:SPY) as a hedge.

Since its inception on Jan. 1 of 2021, the strategy has handed out an impressive compound annual growth rate (CAGR) of 18.81% with a max drawdown of 17.3%. In the past year, the strategy has returned 15.61%, outperforming the S&P 500’s loss of about 14%. With that in mind, let’s take a look at the ten short positions in the strategy:

- Devon Energy (NYSE:DVN): Net Asset Value (NAV) of -6.67%.

- Chevron Corporation (NYSE:CVX): NAV of -6.35%.

- Macy’s (NYSE:M): NAV of -6.27%.

- Danaher Corporation (NYSE:DHR): NAV of -6.12%.

- General Electric (NYSE:GE): NAV of -6.08%.

- Microsoft (NASDAQ:MSFT): NAV of -6.03%.

- Walt Disney (NYSE:DIS): NAV of -5.96%.

- Amazon (NASDAQ:AMZN): NAV of -5.95%.

- Morgan Stanley (NYSE:MS): NAV of -5.89%.

- Johnson & Johnson (NYSE:JNJ): NAV of -5.67%.

On the date of publication, Eddie Pan held a LONG position in AMZN and MSFT. The opinions expressed in this article are those of the writer, subject to the InvestorPlace.com Publishing Guidelines.