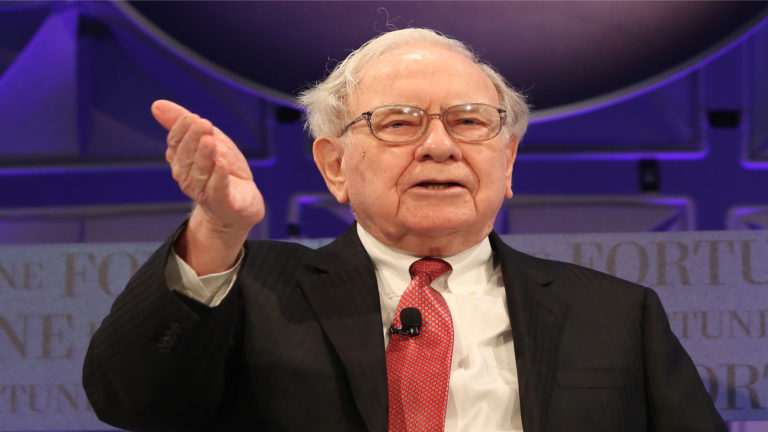

Warren Buffett is widely known as one of the best value investors of all time. However, there is more that goes on in his thought process than just value. In his 2023 shareholder letter, he quoted Charlie Munger’s advice to him in 1965:

“Warren, forget about ever buying another company like Berkshire. But now that you control Berkshire, add to it wonderful businesses purchased at fair prices and give up buying fair businesses at wonderful prices. In other words, abandon everything you learned from your hero, Ben Graham. It works but only when practiced at small scale.”

Indeed, most of his holdings are actually in quality companies that are meant to compound over the long-run, like Apple (NASDAQ:AAPL). That said, Buffett is flexible with is picks, having recently trimmed many of his premium holdings in the past few quarters. I believe he could rotate a lot of this cash into some value stocks, as he has done so many times in the past. Here are three that could fit the bill for investors like Warren Buffett seeking out value stocks with strong growth prospects.

FedEx Corporation (FDX)

FedEx (NYSE:FDX) is a company that doesn’t really need an introduction. The firm’s latest earnings report shows signs of stabilization and efficiency gains, even as macroeconomic headwinds persist.

Notably, FedEx delivered $5.41 of adjusted earnings per share in Q4, beating consensus estimates by 4 cents. Full-year adjusted earnings per share also came in at the higher end of initial guidance, growing an impressive 19% year-over-year. These results were notable, as they came despite revenue falling short of original expectations. I’m encouraged by the management’s ability to expand margins through its DRIVE program, which achieved its $1.8 billion cost reduction target.

What’s more, FedEx is generating robust free cash flows while reducing capital intensity ahead of schedule. This allowed the company to return $3.8 billion to shareholders in 2024. With the stock trading at just 0.8-times sales and a reasonable price-earnings ratio relative to its projected earnings growth, it’s also quite cheap.

Buffett does not have a history with FedEx. I find that surprising, considering how relevant and solid this business is. “I believe Warren Buffett will acquire Federal Express [in 2020],” Doug Kass, president of the hedge fund firm Seabreeze Partners Capital Management and a longtime Buffett watcher, said a few years ago. That hasn’t happened, but it certainly could in 2024.

TC Energy (TRP)

TC Energy (NYSE:TRP) operates a vast network of natural gas and liquids pipelines across North America. The company’s Q1 results impressed, with TC Energy reporting record earnings and 11% EBITDA growth. The company is making solid progress on its secured capital program. It placed about $1 billion of projects into service so far in 2024, largely on budget.

TC Energy has also executed on its $3 billion asset divestiture program, with the recent $1.1 billion sale of PNGTS among the most notable in this regard. The proposed spinoff of South Bow is also moving forward as planned. While TRP stock has dipped lately, I believe it’s nearing a bottom, and offers a tempting 7.3% dividend yield for those patient enough to wait for a turnaround.

Considering Warren Buffett’s affinity with pipeline stocks and his hints at pursuing Canadian opportunities, TC Energy could be a prime target for the Oracle of Omaha. The company’s robust margins make it a classic Buffett-style investment.

Click to Enlarge

I wouldn’t be surprised to see Berkshire take a stake in TC Energy in the coming quarters.

TD Bank (TD)

TD Bank (NYSE:TD) is one of the largest banks in Canada. While Q2 was a strong quarter with earnings of CAD$3.8 billion and EPS of CAD$2.04, I have some concerns. Management acknowledged serious anti-money laundering deficiencies in the U.S. that allowed criminals to exploit the bank. This is a major red flag.

Now, TD is investing CAD$500 million to overhaul its AML program, but the damage to its reputation could linger. Regardless, it is very safe, despite the low leverage ratio. The lender’s Tier 1 and Total Capital ratios, which are considered more comprehensive measures of a bank’s financial strength, are significantly better than the industry median.

Click to Enlarge

The stock’s 34% decline from its peak could present a compelling entry point for value investors like Warren Buffett. He loves well-established banks almost as much as oil stocks. His $5 billion Goldman Sachs investment in 2008 was a master stroke in this regard. With Buffett eyeing Canadian assets, TD’s depressed valuation might entice him.

The bank’s strong earnings demonstrate the resilience of its diversified business model amidst challenges. And a 5.4% dividend yield sweetens the deal for income-seekers. While TD’s money-laundering issues give me pause, I believe the recent sell-off in this top Canadian bank is likely overdone.

On the date of publication, Omor Ibne Ehsan did not hold (either directly or indirectly) any positions in the securities mentioned in this article. The opinions expressed in this article are those of the writer, subject to the InvestorPlace.com Publishing Guidelines.