Meta Materials (NASDAQ:MMAT) stock is back below 10 cents after the company announced that it had agreed to sell 75 million shares of common stock for 8 cents per share and accompanying warrants to purchase 75 million shares of common stock to institutional investors in a $6 million direct offering. The details of the institutional investors were not immediately disclosed.

These warrants will carry an exercise price of 9.5 cents and will be exercisable six months after the issuance date with an expiration date five and a half years after the issuance date.

The company expects to receive $6 million of gross proceeds before accounting for placement agent fees and other expenses.

MMAT Stock: Meta Announces $6 Million Direct Offering

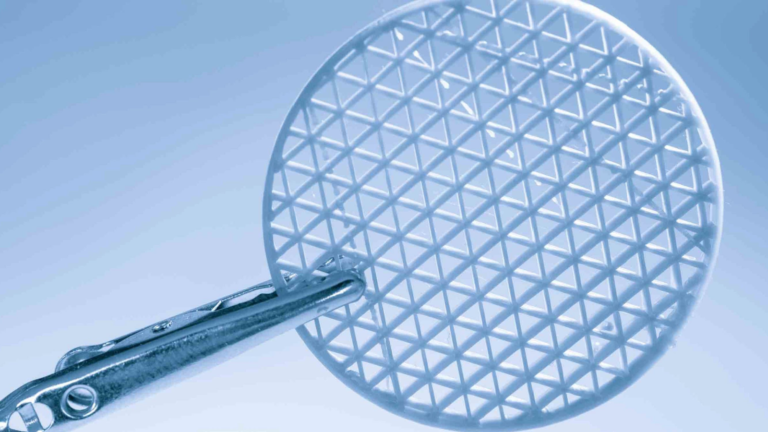

Meta has stated that it will use the net proceeds towards the “expansion of its technology commercialization and sales efforts (specifically in bank note and brand authentication, NPORE® and NCORE™ for Li-ion battery applications and VLEPSIS® systems for wide area motion imagery), as well as for general corporate purposes.”

The direct offering is expected to close on or before Dec. 6. Alliance Global Partners has been named as the sole placement agent.

Additionally, Meta also announced amendments to certain existing warrants issued in June 2022 to purchase up to 25.92 million shares of MMAT stock. Warrants to purchase up to 23 million shares will now have an exercise price of 9.5 cents instead of $1.75. These warrants will be exercisable immediately with an expiration date five years after the amendment. The remaining warrants to purchase up to 2.92 million shares will also have a reduced exercise price of 9.5 cents and will be exercisable six months after the amendment date with an expiration date five and a half years after the amendment date.

As of Sept. 30, Meta had cash and cash equivalents of $10.2 million, which includes $1 million in restricted cash. As of Nov. 7, there were 490.41 million shares of common stock outstanding.

All in all, Meta’s announcement signals that dilution is on the way due to the issuance of new shares and the potential exercise of the accompanying warrants. This could have the effect of lowering the price of MMAT stock.

On Penny Stocks and Low-Volume Stocks: With only the rarest exceptions, InvestorPlace does not publish commentary about companies that have a market cap of less than $100 million or trade less than 100,000 shares each day. That’s because these “penny stocks” are frequently the playground for scam artists and market manipulators. If we ever do publish commentary on a low-volume stock that may be affected by our commentary, we demand that InvestorPlace.com’s writers disclose this fact and warn readers of the risks.

Read More: Penny Stocks — How to Profit Without Getting Scammed

On the date of publication, Eddie Pan did not hold (either directly or indirectly) any positions in the securities mentioned in this article. The opinions expressed in this article are those of the writer, subject to the InvestorPlace.com Publishing Guidelines.