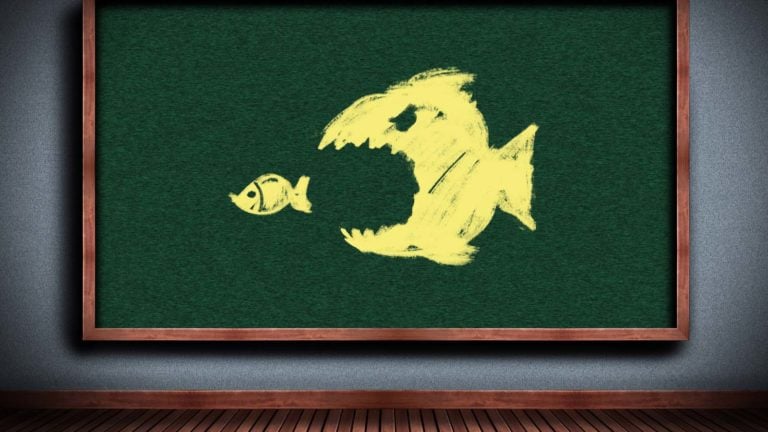

There is an interesting trend among tech stocks these days: Many technology giants are following an old playbook.

Much like the industrial giants of yesterday, today’s tech stocks are quickly becoming conglomerates — with their hands in many different dishes. Think about it, Amazon (NASDAQ:AMZN) isn’t just a retail name anymore, but one with a variety of revenue-generating streams. Microsoft (NASDAQ:MSFT) is more than just software, and includes countless other hardware products. The latest example of this conglomeration of tech can be found in Alphabet’s (NASDAQ:GOOG, NASDAQ:GOOGL) recent purchase of Fitbit (NYSE:FIT).

The point is, Big Tech is becoming bigger tech — and many single-niche players are the targets. The question for investors is: who could be next?

There are plenty of cloud, hardware and other tech stocks that operate in profitable niches. Many of which, could tuck in nicely into some of the larger tech firms’ businesses. Alphabet buying Fitbit, for example. However, it won’t be the last — especially with Big Tech’s huge cash balances and cash flows.

So, who could be the next tech stock to see some serious mergers and acquisitions (M&A) interest? Here are five that fit the bill:

Possible M&A Target Tech Stocks: Etsy Inc. (ETSY)

I’m actually a little shocked that Etsy (NASDAQ:ETSY) hasn’t already been bought out by a bigger tech or retail name. The firm was the first to move into the handmade goods space, and has quickly become go-to e-commerce site for these sorts of items. Amazon’s Handmade doesn’t even come close to Etsy’s sales volume. That strong branding has allowed Etsy to continue to see rising sales and activity over the last few years.

Last quarter, revenues still managed to grow 31.6% year-over-year, while active buyers and seller also rose around 20% or more. That’s pretty good growth and underscores the firm’s leadership position in the space. And while profits on the quarter did dip a bit, it was mostly due to lower margins thanks to free shipping and other moves designed to make it more of a leading player in e-commerce overall.

Clearly, Etsy is a good business with strong branding. Under a larger e-commerce provider, many of its woes — costs related to logistics items — can be fixed. Given that its own handmade goods marketplace isn’t going well, Amazon as a buyer still makes sense; as does someone like eBay (NASDAQ:EBAY) who operates in the same sort of marketplace business. Heck, even Target (NYSE:TGT) as a buyer could make sense given the duos similar demographic of shoppers.

Overall, Etsy is a profitable e-commerce stock operating in a great niche. And with a market capitalization of $5 billion, it’s an easy pill to swallow for many tech giants.

Okta (OKTA)

Cybersecurity is one of the biggest trends out there these days — and it’s only getting bigger as we live more digital lives. Okta (NASDAQ:OKTA) is a niche provider of these security for businesses that makes a ton of sense being tucked into a larger tech stock.

Okta solutions come from the cloud as a provider of Software-as-a-Service (SaaS) identity management products. Thanks to digitization, not everyone at an organization should or is allowed to see everything. Managing that is OKTA’s specialty with products ranging from passwords and two-factor authentications, to customer-loyalty programs and data collection.

It’s a pretty impressive niche to be in, and that’s evident by Okta’s continued revenue growth and impressive $1 billion backlog. Revenues for the third quarter grew 45% YOY, while subscription revenues jumped 48% YOY. The subscription revenue number is particularly important as it means that firms are sticking around to use OKTA’s products. And as the identity market continues to expand, there’s still growth to be had. Okta’s CEO Todd McKinnon even thinks that firm could be bigger than Microsoft or Google.

That is, if they don’t buy them out first. The truth is, OKTA’s products would make a great acquisition for many other networking and cloud players like Microsoft or even Cisco (NASDAQ:CSCO). While it is isn’t small at $14 billion in market cap, it’s certainly doable for many of the largest tech stocks.

Splunk (SPLK)

We make a ton of data these days, and digging into all those terabytes of information has become big business. It’s also the reason why Salesforce (NYSE:CRM) ended up buying Tableau for a cool $15.7 billion. With that said, it is a reason why Splunk (NASDAQ:SPLK) could be the next to go.

Like Tableau, SPLK is a big-data specialist and provides a variety of business intelligence software to collect, manage and analyze all the data various organizations make. From machine learning and application analysis, to cyber-security and business analytics, the beauty of Splunk’s platform is that it can be used to collect and analyze almost anything. And, you can cross reference all these things together in profound ways.

Businesses seem to like this fact. Revenues at Splunk surged more than 30% last quarter YOY .

The reason why SPLK could be a big buyout is that like Tableau, its interface is easy to use. Tableau’s products are visual, and similarly, Splunk offers an easy-to-view web interface that doesn’t require advanced programming knowledge to operate. This makes the firm’s products a powerful addition for many other tech stocks offering other cloud, database and server products.

Now, after Tableau was bought out, Splunk began trading at a take-out premium and will require some hefty cash to buy. However, for the right price, Splunk could be a great M&A target for big tech.

Xilinx (XLNX)

The trade war may have finally made semiconductor Xilinx (NASDAQ:XLNX) buyout bait as shares have been battered over the last year or so.

XLNX main chips are called field-programmable gate arrays (FPGAs). These chips allow developers to easily buy one and program it to perform specific tasks. The real win is that FPGAs are able to change every time a device is powered up. More importantly, they offer very high computer power in a small package, which is why they are starting to find their way into everything 5G related.

The opportunity for XLNX is great given that FPGAs have the potential to be a multi-billion market and its the number one player.

The problem for Xilinx is that ever since Intel (NASDAQ:INTC) purchased smaller FPGA rival Altera back in 2016, the stock has traded as a buyout candidate. Everyone thinks a deal is coming and it never has — but today could finally be different. With 5G adoption just getting started and shares lower thanks to the trade war, XLNX stock could be finally in the cross hairs of some larger chip rivals.

Even if a buyout doesn’t occur, Xilinx has plenty of upside and growth ahead.

GoPro Inc (GPRO)

If you had to pick a tech stock similar to Fitbit with its incredible rise and then crash, it would have to be action camera maker GoPro (NASDAQ:GPRO). The stock was a market darling as everyone wanted one of its devices for the holidays. Action-camera footage was also among the top draws on YouTube at the time. However, today, that isn’t the case. The action-camera market may have run its course for mainstream audiences.

Or has it?

As it stands, GoPro is a premium product with a diehard set of fans. Revenues for the company has sort of flatlined, but have been steady. It’ll take the right partner or owner to make it work — and that owner could be Apple (NASDAQ:AAPL).

Apple could expand on GPRO’s lineup of services and cloud storage options, while improving the firm’s video/photo editing software for the better. At the same time, actual hardware could get a boost. Apple makes great cameras for its devices and its own chips could help them run faster. Meanwhile, the premium product fits nicely in Apple’s niche, just like Beats did a few years back.

That being said, there’s plenty of opportunities for cross selling.

Apple would only have to spend about $700 million — a drop in the bucket — to make it happen. With that, GoPro could finally be going gone to the right tech stock owner.

At the time of writing, Aaron Levitt held a long position in AMZN.