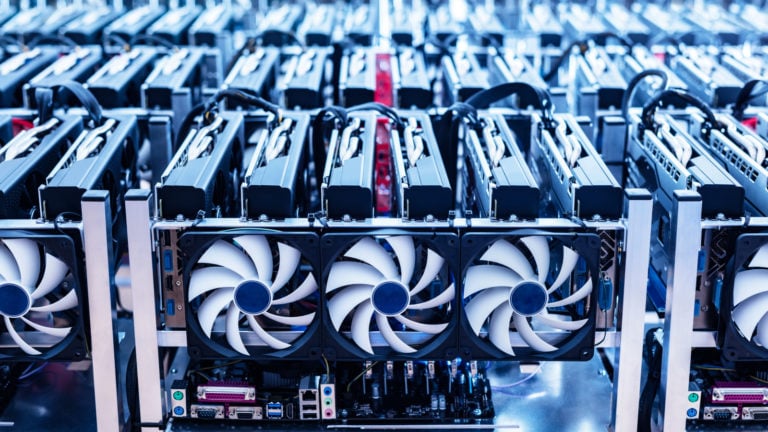

Crypto mining firms like Bit Digital (NASDAQ:BTBT) typically have a positive correlation with the underlying coins. After all, they help feed the supply of various popular virtual currencies. With the digital asset market being as red hot as it is, BTBT stock would seem to be a compelling (albeit speculative) investment.

However, while dozens of individual cryptos have soared to stunning – and in some cases record – heights, Bit Digital has suffered. Since the beginning of the year, BTBT stock has fallen more than 38%. It continues to be an ugly trade, with the blockchain miner losing more than 28% of its value in the trailing month.

However, as swing traders, we don’t really care about the longer-term fundamentals. Rather, we’re here to scalp quick profits. And BTBT stock offers quite the enticing canvas.

Why You Should Bet Against BTBT

The framework for trading BTBT stock is as follows: There’s way more opportunity betting that Bit Digital shares will fall rather than wagering that shares will rise.

Since the beginning of October 2023, there have been 111 trading sessions. Within this tally, 67 sessions opened at a higher price. And the remaining 44 sessions opened at a lower price.

Interestingly, in 38 or 56.72% of these positive openers, the closing price of the session ended up lower than the opening price. On average, the loss came out to 5.53%. Conversely, in 29 or 43.28% of positive openers, the session ended profitably. The average profit came out to 4.53%.

In total, BTBT stock has a negative bias.

Further, when shares fall, they fall at a greater percentage magnitude than when they rise to a profit. As traders, we can use this data to our advantage.

Trade of the Day: Buy BTBT Stock Put Options

With the above framework in mind, here’s the trade of the day. We’re going to buy a near-expiration put option. Should the price of BTBT stock fall, our put contract should rise in value.

Specifically, I’m looking at the 15 March 2024 $2.50 put option. On Monday, this contract closed with a premium of 22 cents. Using Barchart’s options calculator, if we assume that BTBT stock falls 2%, that would yield a per-share price of $2.30. Near the end of Tuesday, this option would have three days to expiration and would be worth approximately 25 cents.

That would give us a profit of 13.6%. And depending on how far BTBT stock falls, the profit could be even greater.

However, we will be trading based strictly on the math. Speculators should only buy the aforementioned put if BTBT opens today at a lower price than Monday’s close of $2.35. And no matter what happens, be sure to exit the trade today. It’s quick in, quick out.

On the date of publication, Josh Enomoto did not have (either directly or indirectly) any positions in the securities mentioned in this article. The opinions expressed in this article are those of the writer, subject to the InvestorPlace.com Publishing Guidelines.