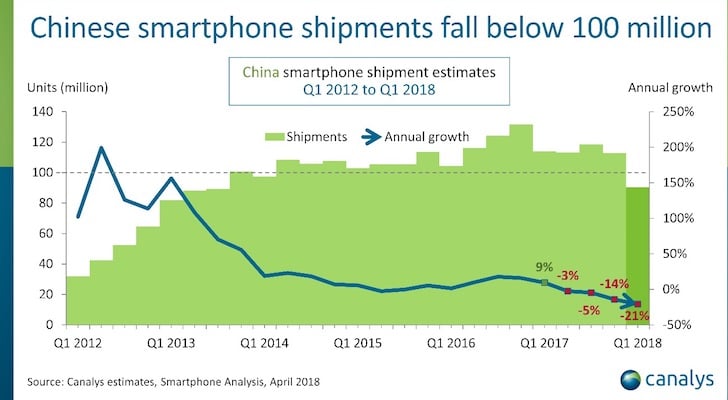

For years, smartphone makers have looked to China for growth as Western markets mature. However, there’s trouble in the world’s biggest smartphone market. According to a report from Canalys, shipments dropped more than 21% in Q1 — its biggest ever decline. This resulted in the Chinese smartphone market hitting levels not seen since 2013. And iPhone sales were low enough that Apple Inc. (NASDAQ:AAPL) dropped out of the top four in that country, replaced by Xiaomi.

Given that AAPL stock is all about the iPhone, this isn’t a great development if you’re Apple, and it’s another wake-up call that the era of explosive smartphone sales growth is coming to an end.

Canalys Report: Chinese Smartphone Market “Suffers a Hard Landing”

Canalys just released its report on the Chinese smartphone market and the numbers aren’t pretty. At least not for companies selling the devices (other than Xiaomi).

According to the research firm’s numbers, smartphone sales for Q1 were down over 21% year-over-year, to 91 million units. That takes sales to 2013 levels and represents the biggest drop ever in China.

China’s Xiaomi bucked the trend by notching 37% gains. That was enough to push Apple out of fourth place in the Chinese smartphone market. And given that the top four accounted for 73% of smartphones sold, that doesn’t leave much to fight over for even the big names like Samsung, or for iPhone sales.

Huawei — which has had to deal with a barrage of negative developments in the past year, including the blocking of its attempts to go mainstream in the U.S. with its smartphones — eked out a 2% gain. Everyone else, including Apple, saw their sales in China head down.

What’s Wrong in the Chinese Smartphone Market?

So what’s going on in China? This precipitous drop in smartphone sales follows a smaller decline the previous quarter. According to Canalys,“there is a sense of fatigue in the market.” Smartphones have all begun to look alike, with similar marketing campaigns and vendors have been trying to sell through inventories of older smartphones. Apple’s iPhone X is definitely different, but with its high price, it’s clearly failed to boost — or even maintain — iPhone sales in the Chinese smartphone market. There is also consolidation taking place in China, as the top four vendors (Huawei, Oppo, Vivo and Xiaomi) squeeze out the competition.

In other words, China is seeing many of the same general factors that have been in play in the Western smartphone market…

Canalys predicts that sales may see positive growth in Q2 as new devices hit the market and convince consumers to upgrade.

Part of a Bigger Trend

The slowing Chinese smartphone market is part of a worldwide trend. Q4 2017 saw global smartphone shipments slip for the first time ever.

Even if there is a recovery in China and globally, the signs are there; we’ve hit peak smartphone.

Gone are the days of explosive increases in smartphone sales volume. The yearly sales records that have driven AAPL stock to such heights are unlikely to repeat. The number of net new smartphone buyers is diminishing. And existing owners are content to wait longer periods between upgrades. Go-to strategies like turning to China are losing steam too, as that market also matures.

For Apple, ASP — average sale price — has turned into the new key metric. With the sheer number of smartphone sales softening, one way to grow revenue levels is to offer more expensive smartphones like the iPhone X. That strategy worked for Apple in the sense that it boosted revenue despite lower iPhone sales in the past quarter, but it risks eroding marketshare.

That can be trouble in the long run, but we’re entering new territory. Time will tell whether that strategy will spell continued success, but based on what’s happening in the Chinese smartphone market, there is definitely risk involved.

As of this writing, Brad Moon did not hold a position in any of the aforementioned securities.

More From InvestorPlace: