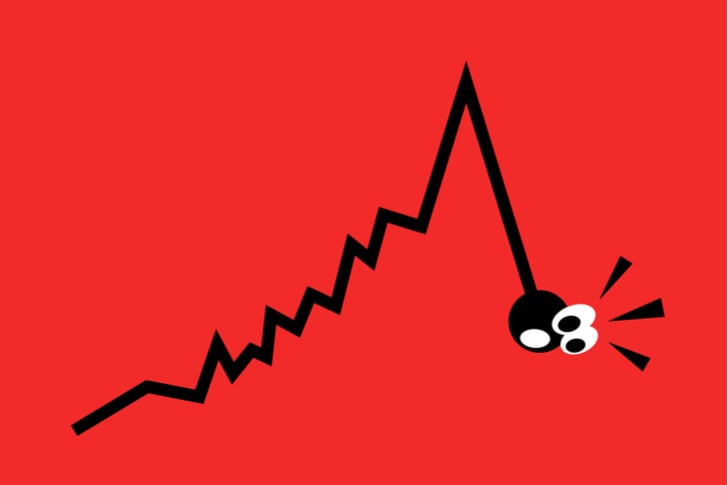

Tech stocks recently generated headlines, but for the wrong reasons. The benchmark exchange-traded fund Technology Select Sector SPDR Fund (NYSEARCA:XLK) slipped this week on potential volatility fears. Investors are worried that if President Donald Trump ratchets up tariffs against Chinese goods, the end result will be an ongoing trade war with China.

Adding to those concerns is a Morgan Stanley report that suggests weakness in the memory market. The sour outlook from some sector players, as well as poor market performance among memory-chip manufacturers, affirmed Morgan Stanley’s bearishness. Should Trump, who doesn’t necessarily have a reputation for being coolheaded, antagonize China further, tech stocks might suffer significantly.

Undeniably, the nearer-term picture is cloudy. But for risk-tolerant investors, negativity from the headlines could open opportunities. After all, every major country is competing vigorously to gain a technological edge. Therefore, fundamentally sound tech stocks aren’t going anywhere.

Furthermore, the Trump administration has a point: the U.S. can’t let Chinese intellectual-property theft slide. While the immediate consequences are painful, in the long run, the tech sector will enjoy deep-seated benefits.

Finally, take a look at the bigger picture. The XLK exchange-traded fund (ETF) is down for the month but is up nearly 16% year-to-date. Here are 15 tech stocks to invest in, despite the noise:

Tech Stocks to Invest In: Nvidia (NVDA)

Over the past few years, Nvidia (NASDAQ:NVDA) tore up the markets. Obviously, that’s a great thing if you invested early. But this bullish trend hasn’t helped prospective buyers looking for an ideal entry point.

But with the China narrative casting a cloud on virtually all tech stocks, NVDA suddenly looks attractive. Shares started promisingly, but continued tariff fears have weighed on its prospects. Should NVDA slip a little bit more – I anticipate it could fall to its 50 day moving average – I’d consider moving in.

Nvidia recently announced its Turing GPU, which could spark a revolution in video gaming due to its enhanced capacities. Moreover, NVDA is a powerhouse in the cryptocurrency-mining sector, where its mining-centric GPUs are a cut above the competition.

Sure, cryptocurrencies have disappointed this year, but interest in the sector remains high. Once the bulls come out of hiding, NVDA could witness a surprising boost in the markets.

Tech Stocks to Invest In: International Business Machines (IBM)

I realize that International Business Machines (NYSE:IBM) is one of the more boring tech stocks to invest in. Nevertheless, for the conservative investor, there’s safety in boredom, especially when Wall Street is presently losing their heads.

IBM stock has had several months to absorb the deteriorating economic relationship between the U.S. and China. Relatively speaking, the response has been muted. IBM shares are virtually dead even with the start of April of this year.

With this proven stability, I have more confidence in buying into management’s recovery campaign. Their Watson artificial-intelligence platform appears very promising. As a crypto investor, I also dig their foray into blockchain technologies.

Plus, IBM pays out a 4.21% dividend yield, and has the free cash flow to support it.

Tech Stocks to Invest In: Intel (INTC)

Intel (NASDAQ:INTC) is among the top tech stocks to invest in that has recently suffered significant setbacks. Since June 1st of this year, INTC dropped nearly 17% in the markets.

A major reason for Intel’s underperformance is its ongoing struggles with their 10-nanometer chips. Admittedly, this is a distraction that bulls could do without. Plus, it sparks negative headlines, which could shake off weakhanded investors.

But I also believe the good news outweighs the bad. For instance, INTC will likely become Apple’s (NASDAQ:AAPL) exclusive iPhone modem provider. Intel rival Qualcomm (NASDAQ:QCOM) recently announced that it will no longer supply modems for Apple.

Beyond that, INTC has a strong earnings-performance track record: they haven’t missed consensus targets since at least the first-quarter 2015 results. Let’s not forget that they do pay out a 2.5% dividend yield, which helps mitigate the volatility.

Tech Stocks to Invest In: Adobe Systems (ADBE)

Adobe Systems (NASDAQ:ADBE) started the year off on the right foot. However, since the second half, ADBE stock has failed to mimic its earlier performances. Since August 29th, shares are down more than 3%.

But rather than get discouraged, I view this situation as a longer-term buying opportunity. Fundamentally, very few companies have the same leverage in their Software as a Service (SaaS) model like Adobe. If you’re a graphics designer or involved in any creative industry, having access to Adobe platforms is indispensable.

Furthermore, the company features excellent financials, ranging from their stable balance sheet to sector-leading profitability and growth metrics. Admittedly, you pay a premium for their consistent predictability, but it’s well worth it under the current circumstances.

Tech Stocks to Invest In: Microsoft (MSFT)

Tech stocks like Microsoft (NASDAQ:MSFT) offer the best reason why I’m bullish on the U.S. prevailing in our economic conflicts. While both sides will suffer, we have the edge: our companies are simply more desirable.

During the 2000s decade, MSFT meandered aimlessly in the markets. But with new leadership and fresh vision came a refocused, resurgent company. Today, Microsoft dominates on multiple fronts, from SaaS, cloud-computing solutions, and even legacy hardware businesses.

The data is undeniable. While consumer sentiment initially lavished praise on Apple’s tablets, those with real computing needs preferred actual PCs. To address this demand, Microsoft still maintains a robust PC business. In addition, their hybrid PC/tablet Surface line resonated with customers.

In other words, management is paying attention to their customers, and their efforts are reflected in the MSFT share price.

Tech Stocks to Invest In: Akamai (AKAM)

Akamai (NASDAQ:AKAM) is another top-ranked name that enjoyed a relatively strong start to the year. In the first half, AKAM stock gained over 12%, despite taking a sizable drop in June. The second half of this year, though, has been a choppy mess.

If you have a longer-term perspective, I’d consider using the weakness to your advantage. For starters, the cloud-delivery specialist has renowned expertise in a highly-demanded industry. Not only does AKAM provide web and mobile-application efficiencies, it also ensures cloud and enterprise security. As a result, major institutions, including the aforementioned IBM and Adobe, utilize Akamai’s services.

Moreover, the company has a recent history of consistently-strong financial performances. The last time Akamai missed its earnings target was for Q2 2015. Since then, the tech firm has either met or exceeded expectations.

Tech Stocks to Invest In: Hitachi (HTHIY)

For most analysts writing about tech stocks to invest in, Hitachi (OTCMKTS:HTHIY) just doesn’t roll off the tongue. A major reason why is that Hitachi, at least from a consumer-electronics standpoint, hasn’t been relevant since 1987.

Okay, I’m being facetious, but you get the drift. Plus, HTHIY stock hasn’t lived up to anyone’s expectations. Shares are down over 17% YTD, with a good chunk of those losses coming in during the past few weeks. Add to the stock’s low volume, and you quickly see why no one really discusses it.

Although a very speculative opportunity, HTHIY has the potential to surprise. For one thing, the company usually exceeds earnings expectations. On another level, Hitachi is involved in the high-growth blockchain industry. Earlier in July, HTHIY announced plans regarding a blockchain-based platform that can process retail transactions via shoppers’ fingers.

It’s this type of forward, innovative thinking that could help bring HTHIY stock out of the mud.

Tech Stocks to Invest In: Square (SQ)

Among tech stocks, Square (NYSE:SQ) is a controversial pick not because of anything scandalous, but because it’s seemingly overheated. SQ already enjoys a 155% YTD performance, so growth potential appears very limited.

Key financial metrics also affirm the overbought argument. Currently, SQ stock trades at nearly 115-times forward earnings. Furthermore, the company’s balance sheet got a little bit more unfavorable thanks to a large debt increase.

I concede that SQ has jumped too far ahead of itself, and therefore, I anticipate a nearer-term correction. But once that occurs, the broader fundamentals support Square’s business model. As the digitally native Generation Z enters the workforce, the concept of bigger, unwieldy companies will likely fade.

In turn, organizations like Square and their focus on disruptive technologies will take their place.

Tech Stocks to Invest In: Carvana (CVNA)

I’ve mentioned online auto dealership Carvana (NYSE:CVNA) twice before. And each time, I wished the price was just a tad lower. But yet so far, I’m 100% justified in my bullishness towards CNVA stock. Do I dare go for a third time?

Yes, but with specific caveats. CVNA is currently experiencing some volatility, and I’m not surprised. Shares have skyrocketed nearly 208% YTD, even accounting for the recent market losses. I’d like to see the bears take CVNA down further, perhaps to around the high-$40 level.

If it gets there, I would again reiterate my optimism for the company. We can talk all you want about its amazing revenue growth, and how management is paring down its net-income losses. For me, it comes down to a simple forecast: this is how millennials and future generations will purchase vehicles.

Tech Stocks to Invest In: Autohome (ATHM)

At one point, Autohome (NYSE:ATHM) shares were up over 80% in the markets and looking to pull off the double. Unfortunately, U.S.-China relations soured, which sent ATHM stock tumbling. That part is completely understandable. China, after all, owns the world’s largest automobile market.

Now, I must admit that I’m not the biggest fan of Chinese tech stocks. And as I earlier mentioned, the U.S. economic machinery is simply superior. China needs us more than the other way around.

But I’m also a pragmatist. With such an expansive consumer base, I wouldn’t gamble against ATHM stock for too long. With shares now up “only” 19.4%, I believe speculators and risk-tolerant investors have a viable contrarian opportunity.

Additionally, ATHM features strong financials across the board. They have an extremely-robust balance sheet unencumbered with debt. The company also enjoys stellar profitability and growth metrics. Therefore, buying into the weakness now could net huge gains later.

Tech Stocks to Invest In: Match Group (MTCH)

Tech stocks and love aren’t necessarily mutually exclusive concepts, as Match Group’s (NASDAQ:MTCH) success has proven. After an incredibly robust performance last year, in which MTCH gained over 80%, the company is back at it again. Since the January opener, MTCH has rocketed to a 60% lead.

Can this extraordinary performance continue? Perhaps the biggest concern for prospective buyers is that Match Group lacks a moat. Online dating isn’t a novel or unique idea. In addition, social-media companies are eyeing this space. With their extensive networks, Match theoretically faces significant challenges.

Still, I’m holding onto the term “theoretically.” Sure, MTCH has competition on the horizon, but the company is still the most popular dating site. Plus, the margin is significantly wide over second-place PlentyofFish.com, which is a free service.

While the concept isn’t unique, don’t be fooled: MTCH levers a marketing moat that will be difficult for the competition to overcome.

Tech Stocks to Invest In: Micron (MU)

Among the most-negatively impacted tech stocks recently is Micron (NASDAQ:MU). Since the end of August, MU stock is down a startling 15%. On Thursday alone, MU dropped nearly 10%.

Fears of ratcheted-up tariffs weighed heavily on Micron. This is a semiconductor firm that gets half of its revenue from China. Therefore, any tariffs or sanctions would cause shares to decline from reprisal fears.

At the same time, the markets have reacted as if China is completely shutting down all Micron products and operations. As management disclosed in July, a Chinese court injunction against MU has a hair over 1% impact toward total revenue.

Granted, a continued deterioration between U.S.-China relations represents a headwind toward MU stock. But this isn’t a one-way street. The Chinese government hurts its own economy and workers when it penalizes American operations within the Asian powerhouse’s territory.

So while the MU decline is shocking, I see the fallout as a buying opportunity.

Tech Stocks to Invest In: Fitbit (FIT)

Another one of my risky ideas, Fitbit (NYSE:FIT) is insanely speculative. When FIT stock was in its doldrums — not that it ever convincingly got out yet — my former managing editor somewhat jokingly asked if anybody had a bullish take. Of course, I took the bait.

But I wasn’t being a contrarian for its own sake. Rather, the company offered attractive, relevant products at very competitive prices. But as the fitness-tracker market became increasingly saturated and tired, Fitbit appeared to lack ideas. That is until they released their Versa smartwatch.

The Versa is typical Fitbit: it’s a gorgeous product that aligns with millennial sensibilities. Better yet, the Versa is priced significantly lower than the Apple Watch. In fact, Fitbit’s latest device has proven so popular that it hit production limitations.

That’s an unfortunate development, but I’m encouraged that Fitbit finally showed offensive capabilities. Is it a gamechanger for FIT stock? With razor-edged focus and the right decisions, management can certainly turn it into one.

Tech Stocks to Invest In: Appian (APPN)

Almost any business venture today needs a modicum of digital presence. To achieve this beyond building a simple website requires computer-coding knowledge.

I’ve dabbled a bit with C++ programming, and I can tell you that it’s a true pain in the rear. Every subsegment of your grand idea must be “handwritten” in a language that a computer understands. Understandably, most people and businesses don’t have time to mess around with coding. They simply need to get their idea into a workable format quickly.

That’s where Appian (NASDAQ:APPN) comes in. Specializing in low-code development, this innovation allows even non-coders to build a computer application in rapid-fire time. How? Low code is essentially a graphical user interface platform: simply point and click your desired elements and you can have an app up and running with minimal fuss.

APPN stock isn’t exactly lighting up the markets this year, with shares gaining only 6%. But once investors really grasp the business concept, I believe sentiment will change dramatically.

Tech Stocks to Invest In: HP (HPQ)

HP (NYSE:HPQ) doesn’t exactly fit most folks’ definition of tech stocks to invest in. Nevertheless, you shouldn’t ignore this understated company as it features some surprising positives.

One of the commonly cited criticisms against HPQ is that it’s a legacy business. Recall that the company spun off its servers and networking business as a separate entity, Hewlett Packard Enterprise (NYSE:HPE). That leaves the original HPQ with the PC and printer businesses.

Some might say that’s a bum deal but the charts say otherwise. HPQ stock is up almost 18% YTD, and part of the reason is that the company makes great products. For instance, I’m writing this story on an HP Envy x360, which I can attest is an amazing laptop.

Another point to consider is that while the printer industry is declining, its descent has slowed. And within this segment, HPQ is taking more global market share. Last year, HPQ was second only to Canon (NYSE:CAJ), while its other rivals lagged far behind.

As of this writing, Josh Enomoto did not hold a position in any of the aforementioned securities.