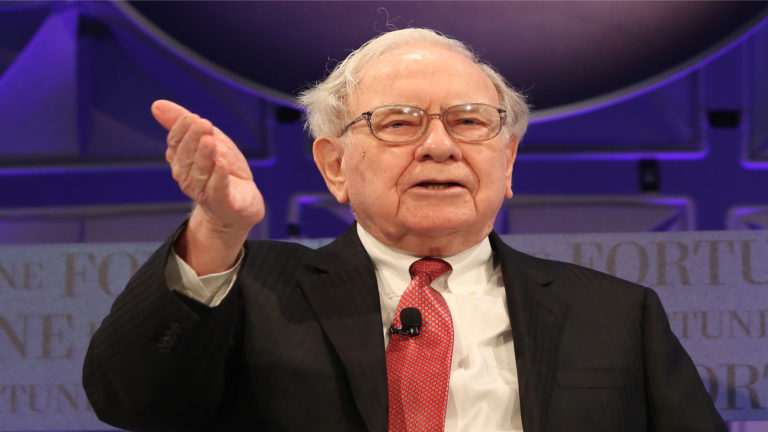

Long-time shareholders of Berkshire Hathaway (NYSE:BRK.A, NYSE:BRK.B) are likely familiar with the Warren Buffett Watch, the CNBC website that keeps a running tab of Berkshire Hathaway’s publicly traded U.S. stocks.

The company’s holdings, based on its September 30, 2019, 13F filing, are worth $256 billion as I write this. Its top 10 holdings account for 83% of the assets, with the remaining 39 stocks accounting for the remaining $44 billion.

The remaining stocks, if they were a publicly traded company, would be the 144th largest in the S&P 500. Bigger than Delta Air Lines (NYSE:DAL), Kraft Heinz (NASDAQ:KHC) and many more. Our fascination with Warren Buffett stocks will carry on long after he’s gone.

The temptation is to buy Buffett’s top 10 holdings and call it a day. Before you do, here’s one mere mortal’s ranking of each of those stocks.

Thumbs up or thumbs down? Read on and you’ll find out.

Warren Buffett Stocks: Apple (AAPL)

Market Value: $80.3 billion

Stake in Company: 5.6%

Rating: Thumbs Up

In January 2019, I wrote about the 7 Reasons Why Buffett’s Bet on Apple Stock Is a Good One. Since that time, the Oracle of Omaha has trimmed Berkshire’s ownership slightly from 249,589,329 shares to 248,838,679, a drop of just 750,650. In that time, Apple (NASDAQ:AAPL) stock has appreciated by 113%, generating $42.8 billion in unrealized gains for Berkshire shareholders.

It turns out that Buffett can make money from technology stocks.

In hindsight, it seems rather comical that investors like myself were debating back in 2017, whether Apple stock had the goods to get to $200. However, if the company’s latest earnings are any indication, is there anything preventing it from it getting to $500 and beyond?

Bank of America (BAC)

Market Value: $32.9 billion

Stake in Company: 10.5%

Rating: Thumbs Down

Berkshire has made more than $12 billion in 2017 by exercising the 700 million warrants the company got from its $5-billion loan it made to Bank of America (NYSE:BAC) in 2011. And since then, it has almost doubled in price. Add in the dividends it has received over the past two years, and it’s easy to see why he’s so smitten with the bank.

However, I find it hard to believe the profits to be made from the bank in the next eight years are going to be anywhere close to the payday Berkshire has received since 2011.

InvestorPlace’s Vince Martin recently discussed the reasons why Bank of America won’t outperform in 2020, despite the fact it’s amazingly cheap.

“Banks are facing real short-term and long-term pressures. The reaction to banks’ earnings seems to reflect those pressures. Put another way, Bank of America stock is selling off because the market is paying attention to what’s going on,” Martin wrote Jan. 27.

When it comes to Bank of America, it appears the low-hanging fruit has already been picked.

Coca-Cola (KO)

Market Value: $23.7 billion

Stake in Company: 9.3%

Rating: Thumbs Up

It seems like only yesterday I was recommending InvestorPlace.com readers consider buying Coca-Cola (NYSE:KO) despite the fact it was one of the weakest performers in the Dow Jones Industrial Average.

That right. Despite the fact, KO stock had a miserly five-year annualized total return of 4.3% between March 2013 and March 2018. I was singing its praises.

My recommendation to CEO James Quincey at the time was to work out a deal with Brown-Forman (NYSE:BF.B) so that it could bring Coca-Cola together with Jack Daniels for the perfect rum and coke.

Of course, that didn’t happen, but Quincey went on a buying spree, investing in Fairlife in 2012, buying Costa Coffee the same year, and, in January, it purchased the remaining 57.5% it didn’t already own.

Since my article in 2018, Coca-Cola stock is up more than 37%, with additional gains likely on the way. Kudos to Quincey for making things happen.

American Express (AXP)

Market Value: $20.2 billion

Stake in Company: 18.5%

Rating: Thumbs Up

Frankly, with all the cash Berkshire has — $128.2 billion at the end of September — I haven’t the foggiest idea why Buffett hasn’t taken American Express (NYSE:AXP) private. It seems like the perfect company to be owned by the conglomerate. It has a wide moat but requires a little tinkering to go from good to great.

On Jan. 24, American Express announced better-than-expected fourth-quarter results. On the top line, it had revenue of $11.4 billion. On the bottom, its adjusted earnings were $2.03 a share, two cents better than the consensus estimate. Sales and earnings grew 8.6% and 16.7% year over year, respectively.

According to CEO Stephen Squeri, Amex delivered its 10th straight quarter of FX-adjusted revenue growth of 8% or higher. In addition, it expects to finish fiscal 2019 with full-year EPS of at least $8.85 a share.

My InvestorPlace.com colleague, Aaron Levitt, recently called American Express, “a powerhouse in the financial sector.”

I couldn’t agree more. Buffett could buy the remainder of Amex and still have cash left over. Come on, Warren. Pull the trigger.

Wells Fargo (WFC)

Market Value: $18.1 billion

Stake in Company: 8.9%

Rating: Thumbs Down

If there is an ugly duckling in Berkshire’s top 10 holdings, Wells Fargo (NYSE:WFC) is the one. In May, I suggested that Buffett continuing to back the beleaguered bank stock was making himself look hypocritical. Eight months later, my opinion hasn’t changed.

“When Warren Buffett’s gone from this planet, he will be missed, most notably by those who were made very rich by his business acumen,” I wrote.

“However, investors will look back on his pledge of allegiance to Wells Fargo and wonder why he remained loyal to that particular bank when there were so many other better ones.”

Of course, I’m not the only one who doesn’t see the attraction in Wells Fargo.

Neil George, the editor of Profitable Investing, recently wrote that in addition to the regulatory issues and growth constraints facing the bank, the fact that its net interest margin (NIM) is only 2.8% in a reasonably healthy economy suggests that I’m right on the money.

There are better banks out there. SVB Financial (NASDAQ:SIVB) is one of them.

Kraft Heinz (KHC)

Market Value: $9.5 billion

Stake in Company: 26.7%

Rating: Thumbs Down

It’s only appropriate that Kraft Heinz (NASDAQ:KHC), Berkshire’s other dog of a top 10 holding, immediately follows Wells Fargo. Misery loves the company.

Unlike Wells Fargo, whose problems stem from a terrible corporate culture, Kraft Heinz’s issues, to no small extent, came to pass because of Buffett’s partners (3G Capital), who never found a dollar it couldn’t save.

Forget for a moment that Buffett himself admitted in February 2019 that Buffett and 3G overpaid for Kraft — Heinz paid almost $40 billion in 2015 — or that 3G’s cost-cutting processes chopped $1.7 billion from the annual expense sheet, the purchase came at a time when Americans’ eating habits were already in transition, away from packaged goods, to healthier alternatives.

New CEO Miguel Patricio has his work cut out for him. This is easily Buffett’s biggest and worst investment.

JPMorgan Chase (JPM)

Market Value: $8.2 billion

Stake in Company: 1.9%

Rating: Thumbs Up

If Jamie Dimon, CEO of JPMorgan Chase (NYSE:JPM), ran Wells Fargo, I’d probably give the struggling bank the thumbs up. Of course, if Dimon were running it, we probably would be talking about how dysfunctional it is. And that’s excellent news for JPMorgan shareholders.

Dimon delivered a second-consecutive year of record profits in 2019. As a result, the board awarded the CEO almost $32 million in compensation last year, 1.6% higher than a year earlier. Dimon’s 10 million shares of JPM stock is worth nearly $1.4 billion at current prices.

It used to be that bank CEOs lived well. Now they are part of the 1/10 of 1%. And while I’m not a fan of Dimon’s worldview outside banking, it is hard to argue with his results since taking the top job at the end of 2005.

Of Buffett’s bank holdings, JPMorgan is the best of the bunch.

U.S. Bancorp (USB)

Market Value: $7.3 billion

Stake in Company: 8.5%

Rating: Neither Thumbs Up or Thumbs Down

U.S. Bancorp (NYSE:USB) reported poor fourth-quarter results on Jan. 15. On the top line, its revenue was $5.67 billion, $110 million shy of analyst estimates while on the bottom line, earnings came in at 90 cents, 18 cents below the consensus. It’s no surprise that USB stock has lost a few dollars off its stock price in the two weeks since.

Despite the big miss, USB remains one of the best-run banks in the U.S. It’s a big reason why I recently recommended investors include it in their income-generating portfolio. Yielding 3.1% as I write this, USB could be the ideal target for a global bank looking to make a bigger splash in the U.S.

M&A is going to heat up in 2020. Getting a 3% paycheck while waiting to see if USB finds a suitor is more than smart. Perhaps that’s why Buffett is still holding.

It might not be the strongest bank at the moment, but it’s no worse than Wells Fargo.

Moody’s (MCO)

Market Value: $6.6 billion

Stake in Company: 13.1%

Rating: Thumbs Up

Moody’s (NYSE:MCO) is another business that would make an excellent addition to the Berkshire bench. Already holding 13.1% of the company, it has managed to build a decent-sized analytics business that continues to be its growth driver.

In the nine months ended Sept. 30, its analytics business generated $1.45 billion in revenue and $413.5 million in adjusted operating income. That’s year-over-year growth of 13.5% and 24.7%, respectively.

By comparison, Moody’s Investor Services (MIS), which includes its ratings’ business, saw revenues and operating profits increase by 2.1% and 0.8%, respectively. While not nearly as growth-oriented as its analytics business, the fact that it accounts for 61% of revenue and 76% of operating profits, makes MIS the foundation upon which all else is built.

While I prefer S&P Global (NYSE:SPGI) to Moody’s, I don’t think you can argue with either of them over the long haul.

Warren Buffett Stocks: Goldman Sachs (GS)

Market Value: $4.5 billion

Stake in Company: 5.2%

Rating: Thumbs Up

Goldman Sachs (NYSE:GS) CEO David Solomon recently stated that starting July 1, the company won’t help take a company public if they don’t have at least one “diverse” board member, with a specific focus on women.

“Starting on July 1st in the U.S. and Europe, we’re not going to take a company public unless there’s at least one diverse board candidate, with a focus on women,” Solomon stated. “And we’re going to move towards 2021 requesting two.”

How dare they?

Solomon pointed out that while it might lose a little business, statistics show that shareholders are rewarded by greater diversity. Over the past four years, those companies going public with at least one female board member outperformed those that were made up entirely of white males.

I’ve been talking about diversity in the board room for several years, so it’s good to see the head of a major financial institution taking concrete steps to balance the reigns of power. Warren Buffett might want to pay closer attention to Goldman. Berkshire has just three women out of 14 board members.

Solomon is a breath of fresh air in the financial services industry.

At the time of this writing Will Ashworth did not hold a position in any of the aforementioned securities.