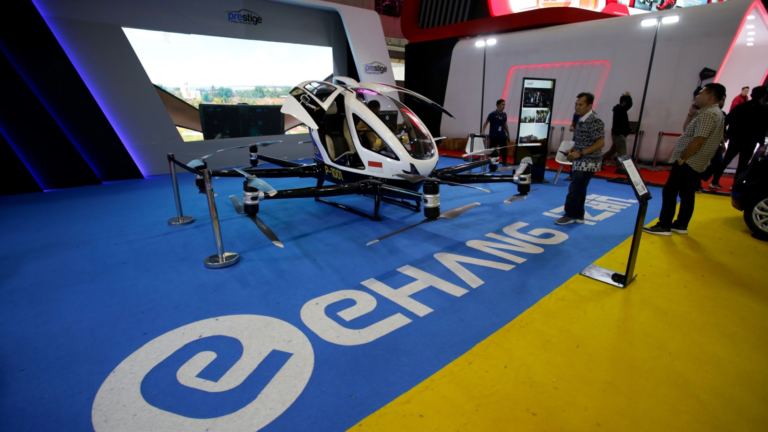

Shareholders of EHang (NASDAQ:EH) stock will soon receive a major update, as the electric vertical take-off and landing (eVTOL) company has announced that it will report its third-quarter earnings on Wednesday, Nov. 22 before the market open.

For the quarter, Wall Street analysts expect revenue of $2 million, signaling year-over-year (YOY) growth of 44.97%. Furthermore, GAAP EPS is expected to be a loss of 15 cents, meaning that the company was unprofitable during the quarter. For the full year of 2023, analysts expect revenue of $16 million, implying YOY growth of about 161%, and a GAAP EPS loss of 62 cents.

EH Stock: EHang to Report Earnings on Nov. 22

The confirmation of EHang’s earnings follows a scathing short report by Hindenburg Research, which accused the company of having an order book based on “dead” or “abandoned” deals. Hindenburg also brought up EHang’s last reported cash balance of $44.9 million and cumulative research and development (R&D) expenses of $97.4 million, which pale in comparison to competitors Joby Aviation (NYSE:JOBY) and Archer Aviation (NYSE:ACHR). Because of the short report, EHang’s upcoming earnings will likely be highly scrutinized by shareholders.

In response to the allegations in the report, EHang noted that the “accumulated orders and pre-orders the Company has received in the past reflected the strong interest and genuine demand from customers for EHang’s innovative electric vertical take-off and landing (“eVTOL”) products.” These preorders will be delivered after receiving the necessary regulatory approval.

EHang also stated that it will provide order pipeline updates “from time to time” and denied Hindenburg’s claim that its order pipeline and sales are misleading. It seems that this response has reassured shareholders, as EH stock is up by more than 6% as of this writing.

EHang CEO Huazhi Hu Responds to Short Report

Today, the company also released an interview transcript from CEO Huazhi Hu. In the interview, Hu noted that Hindenburg’s claims are “rumors and false information” and that the best way to overcome the allegations is to provide stellar operating and financial results. The executive also said that EHang will invest in R&D “more aggressively” in the future while being financially prudent at the same time.

“We have witnessed stronger customer demands for our EH216-S after obtaining TC for various use cases in aerial tourism, urban transportation, aerial logistics, emergency services, etc,” said Hu. “We are also in contact with some well-known customers, partners, aiming to attract more orders in the near future.”

On the date of publication, Eddie Pan did not hold (either directly or indirectly) any positions in the securities mentioned in this article. The opinions expressed in this article are those of the writer, subject to the InvestorPlace.com Publishing Guidelines.