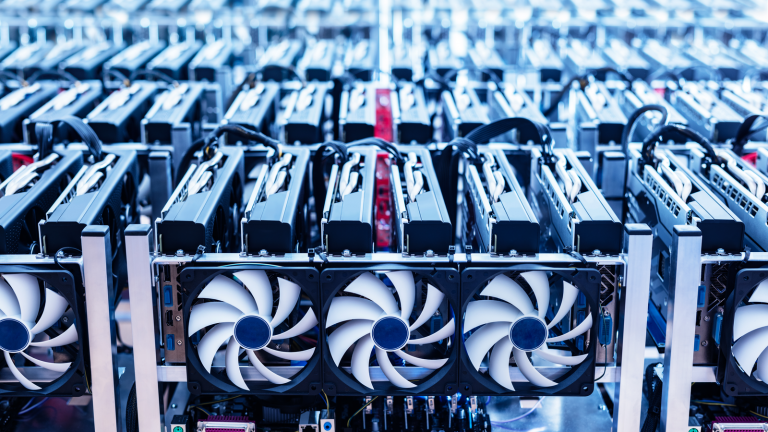

Demonstrating the popularity and resilience of all things cryptocurrency, diversified digitalization enterprise Ault Alliance (NYSEMKT:AULT) — which features a crypto-mining business among several other units — attracted significant speculative attention on social media. Following a corporate announcement regarding robust revenue growth for 2023, AULT stock popped 70% earlier on Wednesday before settling at around 62% up.

According to the press release, Ault projects a revenue haul of $200 million for the current year. In addition, the company reported that it had approximately 2.1 million shares of common stock outstanding. Based on its balance sheet as of March 31, 2023, it estimates the book value of its shares at about $80 per share. It also reported total assets of $527 million.

“These positive projections are a testament to the strength of our business model and our commitment to create value for our stockholders,” management remarked in the release.

Further, the company mentioned that in addition to its crypto-based initiatives, it has strategic investments in innovative biotechnology firms. Though relatively light on details, Ault provided more than enough substance for social media to latch onto. Still, prospective investors need to be extremely careful about AULT stock.

Massive Uncertainty Clouds AULT Stock

While no one will complain about a 60% upshot, the reality is that it changes very little regarding Ault’s long-term picture. For example, even with the massive single-day rally, over the past five sessions, AULT stock gained just under 3%. For the year, shares gave up more than 81% of equity value.

Frankly, circumstances get worse the further out one expands the chart. Over the trailing one-year period, AULT stock gave up nearly 93% of its value. Data from Google Finance reveals that in the past five years, AULT lost 99.99%.

In fairness, investment data aggregator Gurufocus points out that in 2022, Ault posted a revenue of $134.3 million. Therefore, while the aforementioned $200 million target is ambitious, it’s not necessarily unreasonable based on this context.

However, the problem centers on profitability or lack thereof. Last year, Ault suffered a net loss of $181.8 million. In the first quarter of 2023, the company incurred a net loss of $48.6 million, an unfavorable comparison to the year-ago loss of $28.8 million.

Why It Matters

Ault truly takes the term diversified holding company to the absolute limit. According to its website, in addition to the crypto business, Ault “…provides mission-critical products that support a diverse range of industries, including oil exploration, crane services, defense/aerospace, industrial, automotive, medical/biopharma, consumer electronics, hotel operations and textiles.”

It also extends credit to select entrepreneurial businesses through a licensed lending subsidiary. However, with little to show for it in terms of the performance of AULT stock, investors must exercise extreme caution.

On the date of publication, Josh Enomoto did not have (either directly or indirectly) any positions in the securities mentioned in this article. The opinions expressed in this article are those of the writer, subject to the InvestorPlace.com Publishing Guidelines.