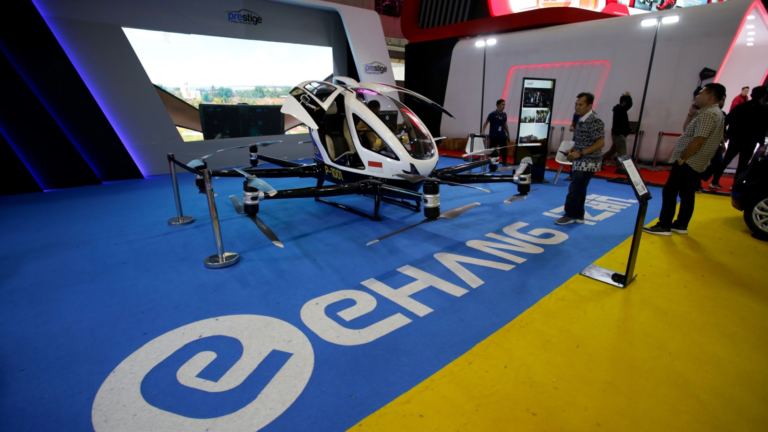

Shares of urban air mobility (UAM) technology firm EHang (NASDAQ:EH) are slipping on Monday despite revealing seemingly positive news. Earlier this morning, management announced a long-term strategic partnership agreement with Wings Logistics Hub, an air mobility-focused subsidiary of Technology Holding Company. Still, although EH stock looks promising as EHang attempts to usher in a new era of transportation, investors should be aware of potential adoption challenges.

According to a press release, the aim of EHang’s partnership with Wings Logistics is to collaboratively “advance the development of urban air transportation and smart city management” in the United Arab Emirates (UAE), the Middle East and North Africa. EHang will join the Smart and Autonomous Vehicle Industries (SAVI) Cluster in Abu Dhabi as part of its UAE expansion.

Per the statement, the SAVI Cluster is “dedicated to establishing Abu Dhabi as a key hub for smart and autonomous vehicles.” Further, SAVI provides “state-of-the-art facilities” and “value-added services” for the underlying electric vertical take-off and landing (eVTOL) industry. The cluster is also led by the Abu Dhabi Department of Economic Development and the Abu Dhabi Investment Office.

Fundamentally, this announcement should bolster EH stock over the long run. As EHang founder, CEO and Chairman Huazhi Hu emphasizes, these recently disclosed initiatives will help the company broaden its reach in the UAE.

EH Stock Features a Mix of Risks and Rewards

Logically, the key benefits of broader eVTOL integration are its environmental and economic impacts. As Wings Logistics board member Mohamad Al Dhaheri states, delivering air mobility services to the UAE is “anticipated to alleviate congestion with zero emissions and, consequently, attract significant foreign direct investment and generate thousands of jobs in the region over the next decade.”

Indeed, by gradually introducing eVTOLs, this effort may help push societies toward net-zero carbon emissions. On top of that, a recent report from SNS Insider projects that the eVTOL market could be worth $22.71 billion by 2030, which represents a massive 50.35% compound annual growth rate (CAGR) from 2023 levels.

With that, the air mobility sector may also spark downwind activities, such as the development of vertiports and charging infrastructures. Further, eVTOLs may provide a link to remote communities, thus unlocking significant economic value. So, with EHang aggressively expanding into a viable market, the framework bodes well for EH stock.

Nevertheless, many challenges remain for this burgeoning industry. Obviously, developing clear safety and regulatory guidelines will be crucial for universal adoption of eVTOLs. Plus, even with rigorous protocols in place, entities like EHang are still dependent on actual consumer adoption of the technology.

The benefits of air mobility — such as reduced environmental impact and noise — need to be considered against a wider context as well. For example, battery charging may still involve power from conventional sources. eVTOLs are not completely silent either and could annoy communities, especially if they become more prevalent.

Why It Matters

Currently, only Goldman Sachs analyst Allen Chang covers EH stock on TipRanks, rating shares as a “buy.” Even better, the analyst’s price target stands at $30.50, implying about 78% upside potential. On a year-to-date (YTD) basis, EH is already up by about 80%.

On the date of publication, Josh Enomoto did not hold (either directly or indirectly) any positions in the securities mentioned in this article. The opinions expressed in this article are those of the writer, subject to the InvestorPlace.com Publishing Guidelines.