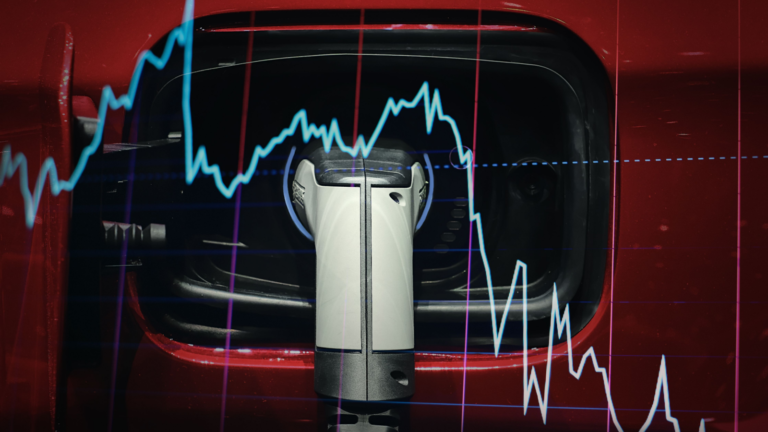

There might be better times to invest in EV stocks, and I think now is the time to look for EV stocks to avoid instead. The sector is grappling with a myriad of challenges, with the biggest fishes losing a ton of value of late. With the sector’s bellwethers struggling, the situation for smaller players becomes even more precarious. Hence, it’s probably the right time for investors to think about the EV stocks to avoid.

With all the headwinds in play, the ultimate result for the EV space is waning demand. Moreover, the race to cut EV prices hasn’t spurred demand as investors would’ve hoped for. Price cuts have had an ironic effect, with investors waiting for prices to bottom out before making their move. Nonetheless, the market’s top players will eventually emerge from the current slump once the headwinds normalize, but the smaller entities may be less fortunate. With that said, let’s look at three EV stocks to avoid, given the current scenario.

EV Stocks to Avoid: Nikola (NKLA)

Nikola (NASDAQ:NKLA) was once a promising player in the EV space; at least, that’s what its investors believed back in 2020. NKLA stock reached an all-time high of $79.73 back in June 2020 but has now dropped an eye-watering 98% from its peak. The slowdown in the EV market is partly to blame but most of it is Nikola’s own undoing.

The company has been marred with controversy, with its founder and ex-CEO Trevor Milton being sentenced to jail for wire and securities fraud. Though he has been replaced, the fall out from this event continues to impact NKLA’s reputation in the public eye.

Controversy aside, Nikola isn’t doing any better with its financials either. Sales were at a measly $35.8 million compared to the massive $966.3 million loss it recorded last year. Moreover, its cash balance has been almost cut in half to $464.7 million compared to 2020.

No wonder its stock has taken a beating, and the bleeding is unlikely to stop anytime soon. According to a recently filed proxy statement, its management will likely recommend a reverse stock split at an upcoming shareholder meeting.

Fisker (FSR)

You might snag some penny candy for nine cents—oh, and maybe Fisker (NYSE:FSR) stock, too! It wasn’t always like that, though, with FSR stock trading at an all-time high of $28.50 in February 2021. However, as mentioned earlier, it now trades for just nine cents, a staggering 99.7% drop from its peak.

Industry veteran Henrik Fisker’s second foray into the automotive space faces incredible difficulty. His first outing, called Fisker Automotive, launched in 2007 and went bankrupt within seven years. However, his latest outing in Fisker Inc. was met with a lot of excitement, which had a lot to do with the company’s tall claims when it went public in 2020. During its SPAC presentation, Fisker forecasted its 2023 sales to skyrocket to $3.3 billion.

However, it only generated $273 million, missing its target by roughly 92%. Moreover, things will not get any better either, with the NYSE having delisted the stock recently.

Lucid Group (LCID)

Lucid Group (NASDAQ:LCID) is a shadow of its former self. To put things in perspective, the embattled Chinese EV player is down more than 90% from its all-time high of $58. The bulls (if there are any) would be quick to point to the broader market slump for Lucid’s debacle. However, the reality is that the firm is collapsing under both external and internal pressures, risking greater losses.

To stay ahead of the competition, the company plans to introduce new technologies such as vehicle-to-vehicle charging and price cuts soon. Moreover, the Saudi PIF wealth fund is at its back, which continues to pour billions into the company.

Despite these apparent positives, it’s tough to foresee a scenario where Lucid snaps back. For starters, these new technologies are subject to the risks associated with lengthy research and development phases. Moreover, with the firm spending money like water, I’d be surprised if these plans ever come to fruition. Also, Morgan Stanley analysts recently downplayed the $1 billion investment from the Saudi PIF wealth fund. The investment bank states that the investment equals just the first half of Lucid’s free cash flow losses.

On the date of publication, Muslim Farooque did not have (either directly or indirectly) any positions in the securities mentioned in this article. The opinions expressed in this article are those of the writer, subject to the InvestorPlace.com Publishing Guidelines.