MicroVision (NASDAQ:MVIS) withdrew its $75 million stock offering after investors rejected it by selling MVIS stock. Following the reversal, shares rose almost 20% overnight.

MicroVision shares were down nearly 28% on July 14, closing at $4.60 per share. The news of rescinding the offer sent shares back to $5.46. The overnight move sent the market capitalization of the lidar company back over $1 billion.

Listen to the Market

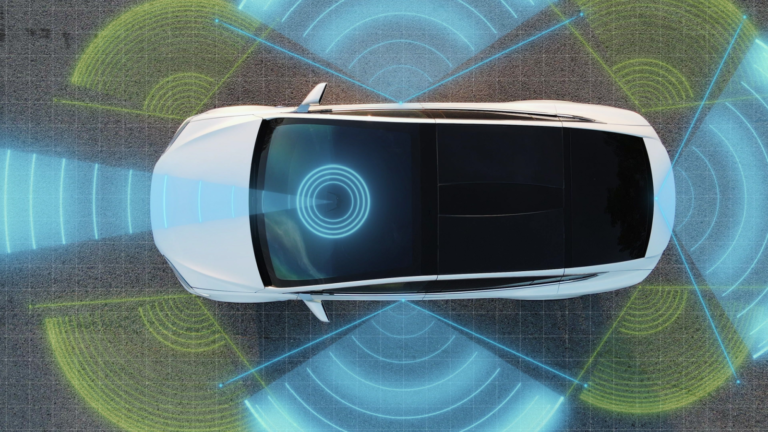

MicroVision makes driver assistance systems, which some equate to artificial intelligence. As InvestorPlace wrote on June 14, the stock recently benefitted from a short squeeze that sent it as high as $7.65/share on June 8.

High interest from retail investors makes MVIS a risky short bet, writes our Thomas Yeung. But those same investors were quick to sell after the stock sale announcement.

Most comments about MVIS stock on June 15 were bullish, focused on the short squeeze. One commenter speculated that MVIS must have some other way to get new investment, or it would not have canceled the offering.

The stock sale was due to replace money lost in operations over the last year and give it a path forward. MicroVision lost $57 million in 2022 and another $19 million in the first quarter of 2023. The company is due to report earnings for the second quarter on

July 27 or Aug. 1. The company listed $23 million in cash and $44.6 million in securities at the end of March.

While the market for lidar systems is growing, much of the growth has been in mapping and disaster management rather than cars. MicroVision competitors have turned to other opportunities. For instance, Luminar (NASDAQ:LAZR) CEO Austin Russell bought a controlling interest in Forbes.

In cars, lidar also faces competition from radar, which Tesla (NASDAQ:TSLA) is using in its autopilot systems.

MVIS Stock: What Happens Next?

MicroVision still needs both cash and customers. Investors should take what the company says at face value and wait for developments, but speculators are going to speculate.

As of this writing, Dana Blankenhorn did not hold (either directly or indirectly) any positions in the securities mentioned in this article. The opinions expressed in this article are those of the writer, subject to the InvestorPlace.com Publishing Guidelines.