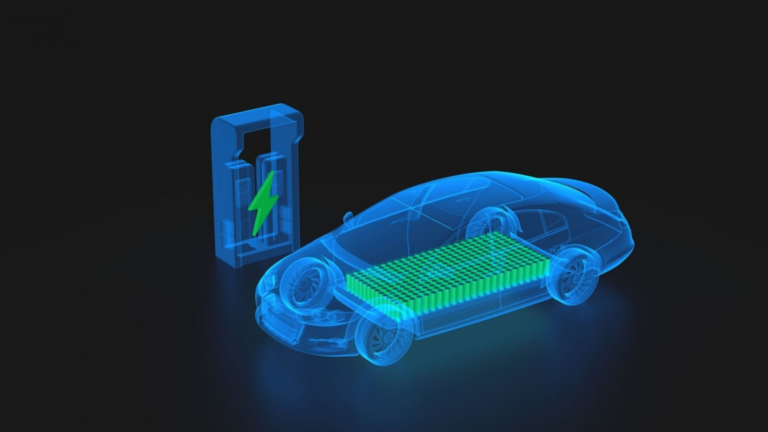

Solid-state batteries are a promising technology that could eventually revolutionize the electric vehicle (EV) market. Unlike conventional lithium-ion batteries, solid-state batteries use a solid electrolyte instead of a liquid one, which offers several advantages such as higher energy density, faster charging, and improved safety. This has led to the rise of solid-state battery stocks to buy.

According to a report by Research and Markets, the global solid-state battery market grew from $0.34 billion in 2022 to $0.49 billion in 2023 at a compound annual growth rate (CAGR) of 44.5%. The market is expected to grow to $2.41 billion by 2027. Overall demand for solid-state batteries will be driven by the increasing adoption of EVs, which are expected to account for 30% of global vehicle sales by the end of this decade.

With all that said, below are three solid-state battery stocks that could set investors up for long-term success.

Toyota Motor Corporation (TM)

Toyota (NYSE:TM) probably needs a little introduction. Founded in 1933, the Japanese automaker has become one of the world’s largest auto manufacturers. Most importantly, Toyota helped start the current hybrid and electric car revolution with the Prius and a growing line of EV and hybrid vehicles. Toyota also owns the Lexus, Daihatsu, Hino, and Ranz brands, plus stakes in Subaru, Mazda, Suzuki, Isuzu, Yamaya, and Panasonic.

Moreover, Toyota has been developing solid-state batteries for over a decade. If commercially scaled, solid-state batteries could address EV battery concerns such as charging time, capacity, and the risk of catching fire.

Recently, Toyota claimed a breakthrough in battery manufacturing technology that would allow the automaker to mass-produce solid-state batteries by 2027 or 2028. With this novel battery technology, the automaker aims to achieve a range of over 1,200 km and a charging time of less than 10 minutes. Any investor interested in solid-state batteries should be paying attention to Toyota.

Albemarle (ALB)

Albemarle (NYSE:ALB) has made several of my lithium stock ‘buy’ lists due to its attractive valuation and position in the lithium market. The company is one of the largest lithium miners that power electric vehicle batteries. However, lithium is not only a key component of lithium-ion batteries but also solid-state batteries. As solid-state batteries increase in demand and more EVs hit the road, Albemarle could fill that demand.

The specialty chemicals producer has produced some impressive financial results in 2023. In particular, Albemarle’s Q2 earnings print beat Wall Street’s estimates on an EPS basis, while revenue came in line with estimates. Albemarle’s management also decided to raise guidance and noted tailwinds in electric vehicle (EV) sales that should drive lithium prices upward. The long-term prospects of EVs and solid-state batteries, coupled with ALB’s relatively cheap valuation should keep investors interested.

Hyundai Motor Company (HYMTF)

Hyundai Motor Company (OTCMKTS:HYMTF) is a South Korean automaker that manufactures and sells passenger cars, commercial vehicles, and electric vehicles. The Korean automaker has a diversified portfolio of brands, including Hyundai, Kia, Genesis, and IONIQ. Hyundai reported impressive global sales results for 2022 despite the challenging business environment, and financial performance has continued to improve in 2023. This makes it one of those battery stocks to buy.

Hyundai has been investing in solid-state battery technology and has partnered with Solid Power to co-develop its next-generation batteries for EVs. The automaker plans for all of its electric vehicles and those of KIA’s to be powered with solid-state batteries by 2023. Furthermore, Hyundai recently announced a partnership with Factorial Energy to test its novel solid-state battery technology and eventually integrate the technology into Hyundai electric vehicles. These developments leave a lot for equities investors to be hopeful for in terms of solid-state battery technology.

On the date of publication, Tyrik Torres did not have (either directly or indirectly) any positions in the securities mentioned in this article. The opinions expressed in this article are those of the writer, subject to the InvestorPlace.com Publishing Guidelines.