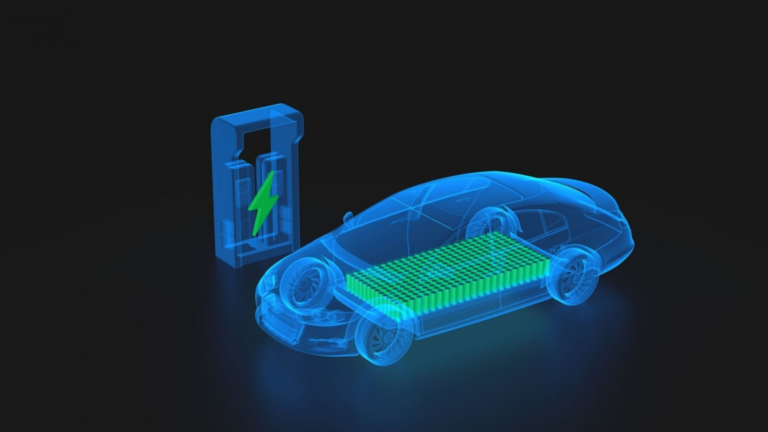

Battery stocks are going to remain one of the best opportunities for many years to come. In 2023. The statistics tell a very strong story for the sector overall. Between April and June of this year, EV sales increased by 48% year-over-year. It is expected that sales will increase by 35% in all of 2023. This market growth has led to the rise of battery stocks to buy.

Those vehicles all require batteries. That market is anticipated to grow by percentages in the mid-to-upper teens between 2023 and 2032. Manufacturers need inputs from battery metals to finished batteries and that isn’t changing. That sets the stage for these stocks and many more to thrive moving into 2024.

So here are the best battery stocks to buy for long-term gains.

Albemarle (ALB)

Albemarle (NYSE:ALB) is one of the best-known lithium stocks. The company has established its position as a leader. I think investors should stick with the leading firms at this point. Albemarle is the biggest lithium producer and the largest lithium stock based on market capitalization. Its scale offers relative safety. That theme of scale and power continues throughout this article. Risk appetite is lower as fear grips the markets. For that reason, investors should stick with the safety of larger firms.

Albemarle is focused on a few things at the moment that matter to its price. Primarily, it is working to bring more lithium production to the U.S. which is important in relation to onshoring efforts and geopolitical considerations. It plans to double its production in Nevada and reopen King’s Mountain Lithium Mine in North Carolina.

The company is utilizing government subsidies to build a concentrator at its King’s Mountain site and has plans to produce lithium hydroxide in nearby South Carolina.

Tesla (TSLA)

Tesla (NASDAQ:TSLA) is best known as an EV stock and for the vehicles it produces. However, Tesla is also a big manufacturer of the batteries it puts in its vehicles.

In truth, Tesla vehicles contain batteries from many manufacturers and what battery you’ll find in a given Tesla vehicle depends on several factors. The Chinese firm CATL supplies Tesla with some of the batteries for its vehicles made in its Shanghai plant. Panasonic is also a major supply partner of Tesla as well as LG. In short, a lot of companies supply Tesla with batteries.

Tesla wants to bring battery production in-house. The more vertical integration, the more control and the more control, the better. The company is producing its own 4680 batteries. Tesla expects the batteries can reduce costs by up to 50% and produces the batteries at its Fremont, California, and Texas gigafactories. The 10 millionth 4680 battery cell was produced at the Texas gigafactory in June. It will be very interesting to see how much lower prices can go especially as Tesla has shifted to a strategy to gain market share through lower prices.

Ganfeng Lithium (GNENF)

Ganfeng Lithium (OTCMKTS:GNENF) is another leading lithium stock. The Chinese firm is one of the leading names in its domestic market which is the largest EV market globally.

I like Ganfeng Lithium for the simple fact that the metrics behind the company are impressive. IN my mind, its growth and value creation make it one to buy. Revenue per share has grown at 90% over the past 3 years and by nearly 98% over the last 12 months. No other firms can really match it, especially at its scale.

However, it has firm control over that growth given that its returns far outstrip the cost of capital used to chase those massive growth rates. The textbook definition of value creation is that returns on invested capital exceed the average cost of that capital required. Ganfeng’s returns are more than double their cost. Ganfeng Lithium is huge and growing very quickly. It’s hard to see why it or the other firms on this list should lose value in the long run or in 2024. This helps to make it one of those battery stocks to buy.

On the date of publication, Alex Sirois did not have (either directly or indirectly) any positions in the securities mentioned in this article. The opinions expressed in this article are those of the writer, subject to the InvestorPlace.com Publishing Guidelines.