It’s been a disastrous quarter for semiconductor stocks. But while big-name semiconductor stocks like Nvidia (NASDAQ:NVDA) and Micron (NASDAQ:MU) plunged to end 2018, Xilinx (NASDAQ:XLNX) managed to spring to all-time highs. Regulatory concerns nailed stocks including NXPI Semiconductor (NASDAQ:NXPI) and Qualcomm (NASDAQ:QCOM). Stronger old-line players like Intel (NASDAQ:INTC) and Texas Instruments (NASDAQ:TXN) sagged despite reasonably solid outlooks. Meanwhile, Xilinx stock is up 56% over the past six months.

That’s in stark contrast to the 9% decline for the VanEck Vectors Semiconductor ETF (NYSEARCA:SMH) over the same time period.

More broadly, Xilinx stock has been on a tear for years now. Since the latest earnings report, XLNX stock has jumped 20%. It traded in the $40+ range as recently as 2016 — meaning shares have nearly tripled over 3 years. But don’t expect this growth to last.

So what has gone so right for Xilinx? And why isn’t it likely to continue?

Xilinx’s Great Earnings

Let’s start with the biggest positive for Xilinx stock going forward: earnings momentum. Throughout 2018, Xilinx was reporting strong numbers despite weakness in the semiconductor sector. Q3 only accelerated that trend. The company’s earnings of 92 cents blew away analyst estimates of 85 cents. Even more impressively, the company grew its revenues 34% year-over-year and sees no slowdown in sight. Xilinx guided to a midpoint of $825 million in revenues for the upcoming quarter against analyst expectations of just $776 million.

What powered these fantastic results? Looking through Xilinx’s divisions on a revenue basis, both communications and the industrial and aerospace/defense segments ran way ahead of analyst expectations. Meanwhile, both data center and consumer/autos merely matched analyst forecasts. That probably shouldn’t be surprising. Other companies have shown weakness in data centers this quarter and the auto cycle appears to be long in the tooth. But communications, in particular, is booming. That’s thanks to 5G.

5G: Are We Getting Ahead Of Ourselves?

To be clear, 5G was the biggest factor in Xilinx’s amazing quarter. It’s long been known that 5G is going to a huge market opportunity for firms such as Xilinx that have heavy exposure to the space. 5G rollout is set to begin in earnest across the globe in coming quarters.

So far, South Korea has been ahead of the pack in launching 5G. However, given Xilinx’s results and commentary from Texas Instruments, it appears that 5G deployment is under way in North America as well.

However, there is a reason to temper our enthusiasm at least a bit. That is, of course, the ongoing trade dispute between China and the U.S. An analyst on the Xilinx earnings call asked management directly if the boom in 5G spending was simply due to Chinese equipment manufacturers stocking up on supplies ahead of increased tariffs and trade restrictions.

Victor Peng, Xilinx’s CEO responded:

“So, look, we’re very sensitive to that situation. So we definitely triangulate from multiple perspectives and also we work on various business things to sort of filter that out. So we don’t believe what’s going on is just pure pull-ins or any sort of double bookings. I would also add that, our strength in wireless is not just in China.”

Hopefully Peng is right, and this is real accelerated demand rather than simply defensive buying due to the trade war. However, it’s worth watching for another couple quarters to see if the 5G demand keeps on running ahead of expectations.

Xilinx Stock Outlook

There are a few things to keep in mind before getting too excited about Xilinx’s recent earnings results. For one, it’s unclear how strong 5G demand and how much is related to trade war issues. Related to that, if the global economic slowdown gains steam, it will probably hit Xilinx’s business in other areas. The industrial and autos segments in particular would be vulnerable to a further stalling out of economic growth.

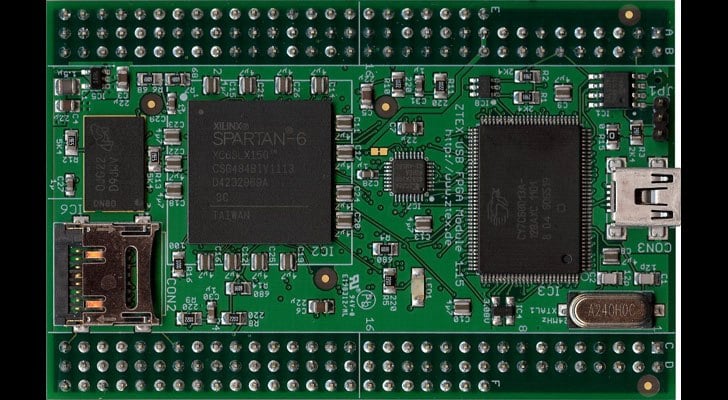

Over the longer haul, it’s unclear how long Xilinx will have the best technology in the 5G space. Sure, they are on the cutting edge now. Xilinx’s field-gate programmable arrays “FGPA” are generally the most capable option at the beginning of a cycle. Eventually, less advanced application-specific integrated circuits “ASIC” will probably sop up much of the demand. But Xilinx should have several years to profit. That said, Intel also tends to bring strong competition and while they may be behind Xilinx now, there’s no guarantee that will last very long.

Investors should also be nervous about the valuation of Xilinx stock up here at $110 share. That puts it at 33x trailing and 29x forward earnings. The current consensus has earnings moving from $3.36 over the past 12 months to $3.81, making for an 11% gain. That’s certainly a nice jump, but it might take more to support the stock at this valuation. The 9.5x price/sales ratio is also really high for a semiconductor company.

In addition, the 1.3% dividend yield, while appreciated, is too small to provide much support for the stock.

The Bottom Line on XLNX Stock

XLNX stock is in uncharted territory as it sits at all-time highs. By all means, it is running on momentum, and that trade could continue for awhile.

But for investors looking at the stock beyond a swing trade, this looks like a poor entry point. Particularly with the semiconductor sector struggling, it will be hard for Xilinx stock to keep flying higher by itself.

At the time of this writing, Ian Bezek owned INTC, TXN, NXPI, and QCOM stock. You can reach him on Twitter at @irbezek.