The collapse of BlackBerry Ltd (NASDAQ:BBRY) has been stunning. But in the tech world, such things do happen with regularity.

Yet BBRY stock is still far from dead. Hey, if anything, it’s amazing that the company has been able to recover from having to deal with the onslaught of mega operators like Apple Inc. (NASDAQ:AAPL) and Samsung (OTCMKTS:SSNLF). Let’s face it, even Microsoft Corporation (NASDAQ:MSFT) couldn’t put up successful fight. This was certainly a major reason why CEO Steve Ballmer stepped aside.

But survival is not enough, of course. So it should be no surprise that — for the past five years — BBRY stock is off about 50%.

OK then, what about the future? Might there be a turnaround? Well, right now, it may seem kind of tough to imagine. But then again, this was the sentiment for say, Advanced Micro Devices, Inc. (NASDAQ:AMD), a year ago, right?

Definitely.

So to gauge the potential opportunity of BlackBerry stock, let’s take a look at three pros and cons:

3 Pros On BBRY Stock

Leadership: The CEO of BBRY, John Chen, is a proven veteran in the tech industry. Back in 1997, he took the helm of Sybase, which was struggling against Oracle Corporation (NYSE:ORCL). But he restructured the operations and redirected the company towards enterprise mobility and commerce. He would ultimately sell Sybase to SAP SE (ADR) (NYSE:SAP) for a hefty $5.8 billion.

Yet Chen also has strong technical chops. Consider that he has a master’s in electrical engineering from California Institute of Technology. He also got his first job as an engineer with Burroughs in 1979.

Reinvention: Transitioning a company from hardware to software is no easy feat. But Chen has definitely made lots of progress with this strategy. In the latest quarter, the revenues from Software & Services came to roughly 55% of the total. Oh, and about 80% was recurring. In all, there were over 3,000 enterprise customer orders in the quarter.

For Chen, he has made some savvy acquisitions, such as for Encription, Good Technology and AtHoc. And another important part of the strategy has been to outsource phone development. This has meant fewer distractions as well as the opportunity to pick-up high-margin licensing revenues.

Something else: Chen has done a good job in leveraging some of the long-time core technology assets. An example of this is BlackBerry Secure, which is a full-blown suite of mobile enterprise apps.

Long-Term Opportunities: BBRY is trying to position itself to get a share of the embedded technology market, which is seeing tremendous growth from the auto sector. Note that the company has BlackBerry QNX, which is a software development platform that provides top-notch security features and has been awarded the ISO 26262 ASIL D certification for cars. The system is optimized to support leading vendors like Nvidia Corporation (NASDAQ:NVDA), Intel Corporation (NASDAQ:INTC) and AMD.

As a testament to the advantages of QNX, BBRY recently signed an agreement with Ford Motor Company (NYSE:F) to cover more car models.

3 Cons On BBRY Stock

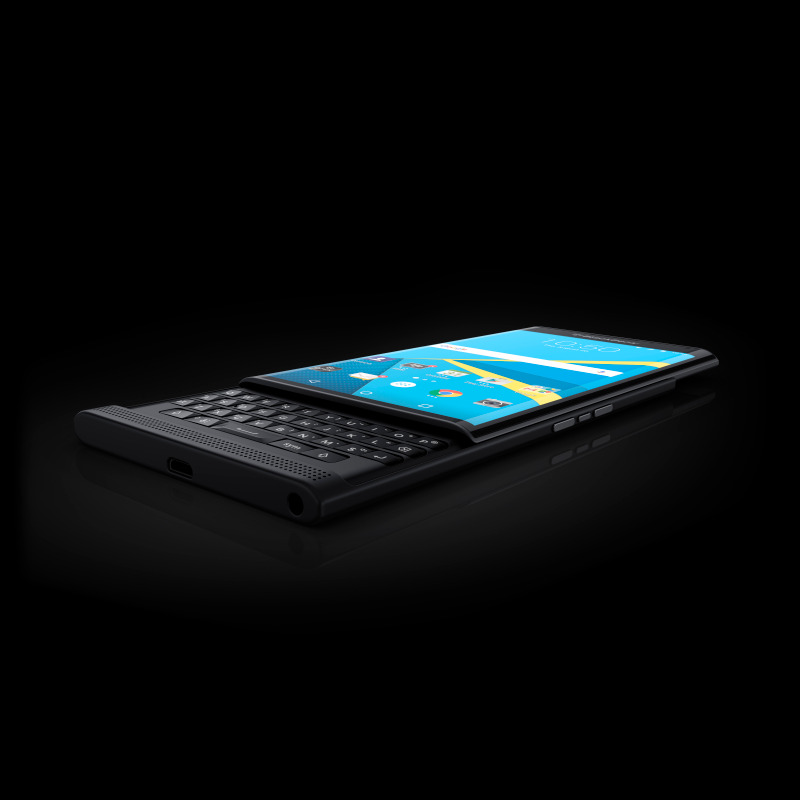

Brand Issues: Back in 2007, BBRY was the global leader in the fast-growing smartphone market. But the iPhone would quickly end this dominance. What’s more, BBRY made plenty of blunders, such as in terms of awful launches.

The result is that the BlackBerry brand is fairly tarnished. Granted, this many not seem to matter as much since the company has moved away from the consumer market. However, the brand could still be a problem with business customers as well. Why use technology from a company that seems to have a dicey future?

Competition: It’s intense. When it comes to the security market, there are many players that have great offerings like Fortinet Inc (NASDAQ:FTNT), Palo Alto Networks Inc (NYSE:PANW) and Check Point Software Technologies Ltd. (NASDAQ:CHKP).

But of course, the market for enterprise mobility solutions also has many tough operators. Just some include VMware, Inc. (NYSE:VMW), MSFT, International Business Machines Corp. (NYSE:IBM) and SAP.

And finally, BBRY’s offerings in the messaging category also must fight against stiff competition, such as with Facebook Inc’s (NASDAQ:FB) WhatsApp, MSFT’s Skype, AAPL’s iMessage and even Snap Inc’s (NYSE:SNAP) Snapchat.

M&A: For the most part, BBRY seems to be good buyout bait. The company’s cost structure has been streamlined, there are strong technology assets and a large customer base.

Yet According to InvestorPlace.com’s Richard Saintvilus: “It has become clear that Chen — who was brought in to build BlackBerry into an M&A target — has taken this company as far as he can take it. Despite all of the boasting the company has done about its superior security capabilities, BBRY stock has had no M&A suitors, suggesting companies like Cisco Systems, Inc. (NASDAQ:CSCO), Oracle Corporation and other enterprise-focused companies with which BlackBerry has often been linked, don’t care.”

Bottom Line On BBRY Stock

Again, Chen has done a great job. Let’s face it, BBRY was a complete mess when he came on board in late 2013.

He wasted little time with cost cutting and outsourcing of the phone business. More importantly, he has invested in areas like security, embedded systems and even the Internet of Things (IoT).

However, despite all this, the fact remains that progress has been grudging. If anything, it will probably still take some time — say a year or so — for the changes to have a real impact. In other words, for those looking at BBRY stock, it’s probably best not to rush to buy it right now.

Tom Taulli runs the InvestorPlace blog IPO Playbook and is the author of various books, including Taxes 2017: Saving A Bundle. Follow him on Twitter at @ttaulli. As of this writing, he did not hold a position in any of the aforementioned securities.